Hey friends, some of you may be following the Venezuelan news and the capture of Maduro by Trump. Im guessing half of you are for it and half of you are against.

I am with a few Venezuelans right now and they all are grateful for the capture of the dictator. They are also nervous about what comes next.

2022 was my first trip to Venezuela (got married in Los Roques 😎). I saw a beautiful country, incredible landscapes and beaches, wonderful people, food, and culture. I also saw a failed state situation with frequent power outages, food and gasoline shortages, abandoned construction sites crumbling after decades of decay and half built rail lines to nowhere.

Many other things to mention that Venezuelans have gone through during the communist dictatorship of 26 years (kidnappings, extortion, torture), but one can guess my opinion about the whole thing. I too am nervous about what comes next and the road will be long, but I believe the direction is right.

I will leave you with a balanced article from a Democratic Venezuelan that opposes Trump to ponder over: Dear Democratic Friends, Please Listen to Venezuelans

Anyway, onto business.

Today I share an email from a reader in which they ask about how to think about deploying a large amount of money given market conditions today, my response included.

A reminder, if any one has questions or comments, please send them through, makes for great newsletter ideas.

Have a great day.

Personal Finance

Hi Eddie, I wanted to reach out to say that I really enjoyed taking your course and have also been enjoying your weekly newsletter. I find the simplicity and clarity of your approach refreshing, especially in a space that often feels unnecessarily complex or over-engineered.

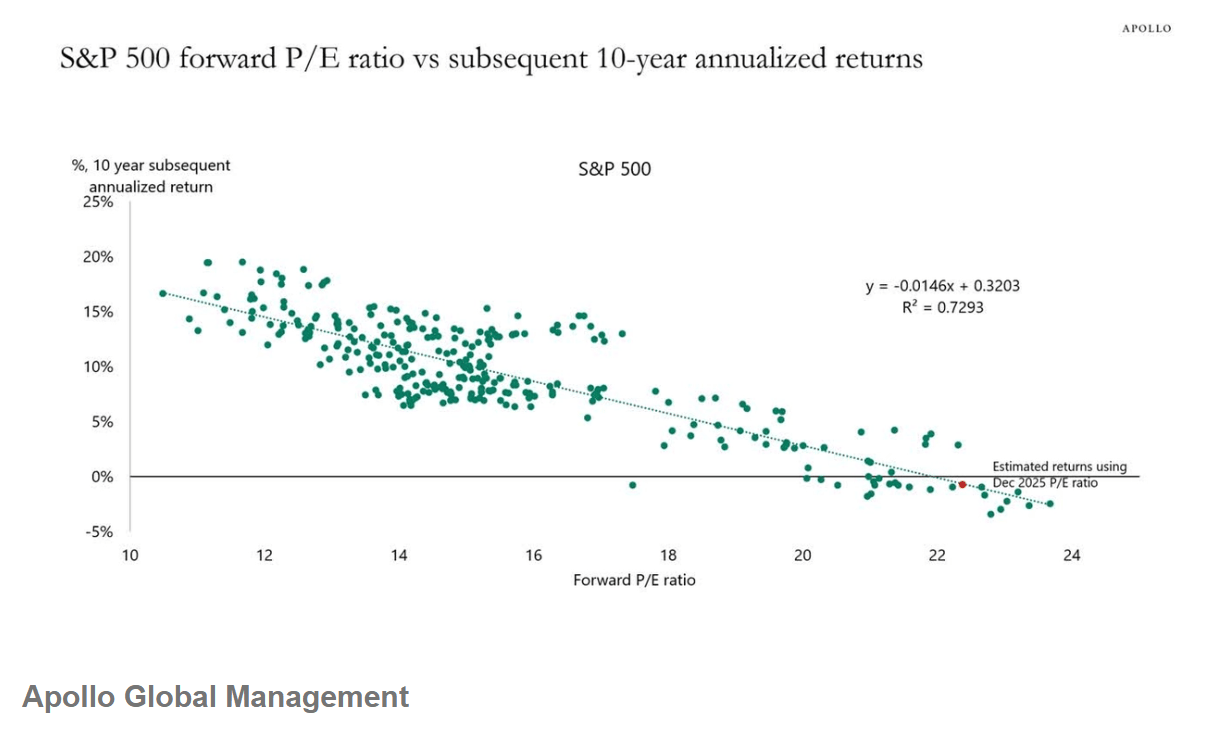

I had a question I was hoping to get your perspective on. I’m currently facing the decision of deploying a large amount of capital that is sitting in cash, and I find myself feeling hesitant given where valuations sit today. As shown in the charts below, the S&P 500’s long-term P/E ratio is hovering around ~22–23x, which makes the timing and drawdown risk feel more pronounced.

More broadly, when the S&P 500’s forward P/E is high (e.g., above ~23x), subsequent 10-year annualized returns have historically been low — often in the low single digits, and in some cases near zero or even negative. That backdrop makes the question of how and when to deploy capital feel especially important.

You talk a lot in the course and newsletters about dollar-cost averaging, which intuitively makes sense to me in this context. I would assume your general guidance would be to invest gradually over time and hold uninvested capital in money market or other low-risk instruments while doing so — but I’m curious how you think about this tradeoff when someone is sitting on a lump sum and valuations appear elevated, and what timeframe you would generally consider appropriate for deployment.

If this is a question you think others might be grappling with as well, it could make for an interesting discussion point in one of your weekly newsletters.

Appreciate any thoughts you’re willing to share, and thanks again for the work you put out — it’s been genuinely helpful.

My Response:

Thanks for the note and kind words - glad you found the course useful and enjoy the Journal.

First I have questions:

How old are you, married, kids, planning to?

Any debts, upcoming large expenses, house purchases, etc?

What do you do for work and how will that likely trend, what is your household income, and what are your lifestyle expenses including taxes today and what do you expect them to be in retirement?

How much do you have liquid invested currently, and in what assets, and do you have emergency savings?

Any business or private real estate assets and associated prospects and debts?

Retirement goals and potential inheritance to be received or planned for future family.

These are the kind of questions that can help identify your ability to take risk while later considering your tolerance to take risk.

Regarding ability, it is about what resources (financial and human capital - which includes time) you have and likely will have to support your basic needs today and long term goals. Less resources = less risk. More resources = higher risk.

Regarding tolerance, this is more emotional in nature. The fact you are asking about timing and valuations, I assume you are partly opportunistic in nature but also risk averse at the same time. Most of us are! Everyone wants higher returns with less risk. Unfortunately, that doesn’t really exist.

In practice, the emotional upside for outperformance is far outweighed by the emotional downside of losing money - whether that be realized losses or just paper losses. This is why diversified portfolios exsist and why advisors and fund managers build broad based portfolios in order to both smooth near term volatility and avoid catasrophic losses.

Empirically, however, long term data support lump sum investing on day one if your time horizon is long enough. Also, just because valuations are historically high doesn’t necessarily imply a worthwhile timing signal.

For example, if you decided not to invest in 2021 when valuations were same level as today, would you have had the gusto to deploy when the market fell 22% in 2022? You might think yes, but most didn’t. Then you would have missed the next 3 years and stocks ran another 50% higher than peak 2021. It was a dark time (people have short memories) and many have sat this bull market on the sidelines and now are wondering what to do.

Also, just because P/E is high, that’s based on today’s earnings expectations, which change frequently. Maybe earnings increase faster than expected, therefore we could see stocks rise while P/E multiple contracts.

Finally, market cycles typically end when liquidity dries up. And from my view we simply don’t have that situation in the US. It’s actually trending the oppposite, money is being created and liquidity coming into the system.

I will note that I am admittedly skeptical of a continuation of incredible returns in the near term but I am no market timer and will continue adding to my stock portfolio with my income despite my emotional hesitancy.

So while the charts are interesting, I’d be cautious of temporarily waiting on the sidelines for a better entry point because temporarily easliy becomes permanent.

Dollar cost averaging strategy is probably a good idea to account for the risk aversion (though again, DCA doesn’t guarantee better long term returns, just smoother). In other words, leg into the market over a period of 6-18 months (again gauging both your capacity and tolerance to take risk) in three equal tranches. I would also suggest that you be pepared to “bring forward” future tranches if the markets pull back by certain amounts, ie if the market falls 10%, or 20%, or 30% etc, you might bring forward some or all of the next tranche to take advantage of those lower prices.

That’s it for now…context matters so hopefully I’ve helped give you some things to think about without knowing much about your situation.

Eddie

Build wealth the way I actually do it 🧠

My ETF investing course walks you through the exact system I use—simple, low-cost, and built for real people with real lives. You’ll learn how to invest confidently without chasing headlines or picking stocks.

👉 Save 10% with code SIMPLYINVEST →

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

Charts below that were shared and I included one from Visual Capitalist at the bottom. Taken together, I hope they help you contextualize how important it is to be a long term investor rather than try and time (gamble) markets.

This first chart shows the P/E Ratio for the S&P500. It is often used as a first attempt to find out whether markets are expensive or cheap. There are issues with using this chart as a timing indicator which I’ll save for another newsletter.

This chart shows the SP500 forward P/E Ratio vs subsequent 10 year annualized returns. It also estimates that forward 10 year returns will be “flat” as indicated by the little red dot on the bottom right of the chart. There are issues with this as well.

This is a visualization of the cost of Timing the Market. It highlights how timing can result in significant setbacks to your long term returns if you miss just a handful of the best trading days over the last 20 years.

Investment returns are 55% lower if you miss just 10 of the best trading days, seven of which took place in bear markets. Investment returns are 93% lower if you miss 60 of the best days.

20 years means approximately 5,000 trading days. How is one supposed to reliably time the stock market and perfectly participate in the 10 best days?

1 Quote

“Time IN the market is always better than Timing the market”

—anonymous

A Question

What are your feelings on the stock market lately?