Morning friends, today’s menu:

A quick financial checklist I am working on for 2026, included my budget template for you to download.

Highlighting the importance of long term investing, over 20 years you never lose.

2025 real estate acquisition summary and on the lookout for 2026.

Favour to ask - if you have been enjoying this weekly mailout and have yet to share with anyone else - please do - I greatly apprecaite it!

Personal Finance

2026 is here and the short checklist I am working through financially:

2026 monthly budget - done ✅

TFSA Contributions - $7,000 for Mj, $7,000 for me - done ✅

RESP $10,000 contribution for Julia - done ✅

Download all credit & debit card transactions to Excel for review and tax preparation - done ✅

I like to get out in front of these activities before life gets busy.

Very important to immediately contribute to your TFSAs so you maximize tax free time in the market.

RESP contributions are important for the kid’s future education (tax free growth and then withdrawals at her future 18-year-old low tax rate). If you have a lot of financial resources, best option is to plunk the max $50,000 into the RESP right away to maximize time in the market. You foregoe some of the “free grant money” from the government when you do this, but, empirically speaking, it is better to invest a large amount up front rather than lower your contributions just to pick up the ‘free money’. The grants are really meant for those who cannot afford to invest large lump sums today. I picked somewhere in the middle and invest $10,000/year for Julia which gets a decent chunk into the market right away.

Also worthwhile reviewing your total spending for 2025 and use it to inform your budgeting for 2026. Budgeting can be daunting the first time you do it but once you get comfortable, by the second or third time, it will be fairly straight forward. The best part about my budget which I prefer over the typical budgeting templates out there is that we look at an entire year on a month-by-month basis all on one screen. So you can easily think forward to any trips planned this summer and even start plugging in birthday and christmas gifts which people often forget about.

These little things go a long way, so don’t wait.

Build wealth the way I actually do it 🧠

My ETF investing course walks you through the exact system I use—simple, low-cost, and built for real people with real lives. You’ll learn how to invest confidently without chasing headlines or picking stocks.

👉 Save 10% with code SIMPLYINVEST →

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

ALOT going on in the market yet again - seems like we are going to repeat the same crazy news flow of Tariff Tantrum 2025. We have Venezuela, Iran, China, etc; Trump calling Federal Reserve Jerome Powell a criminal; Trump going after financial stalwarts Visa and Mastercard et al… it never ends…and it never will!

End of the day, everyone here well understands the importance of tuning out the noise and investing with a long term time horizon.

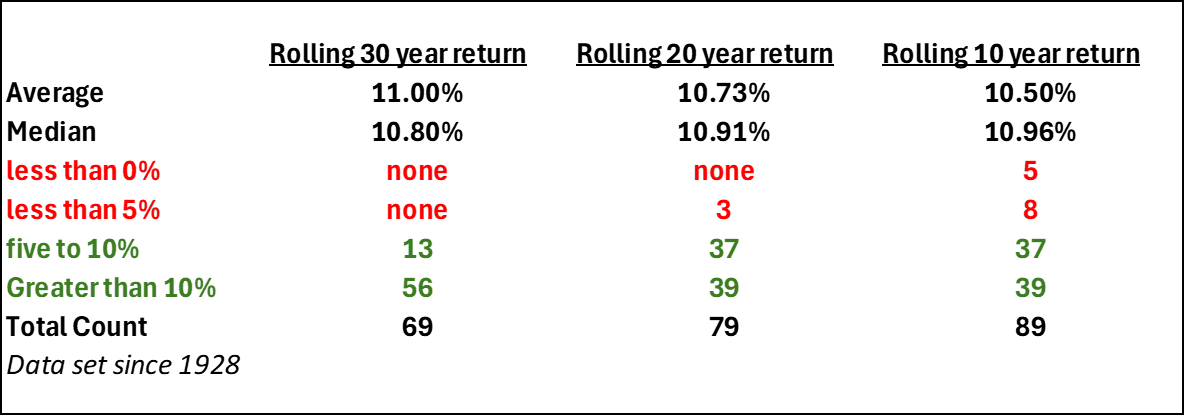

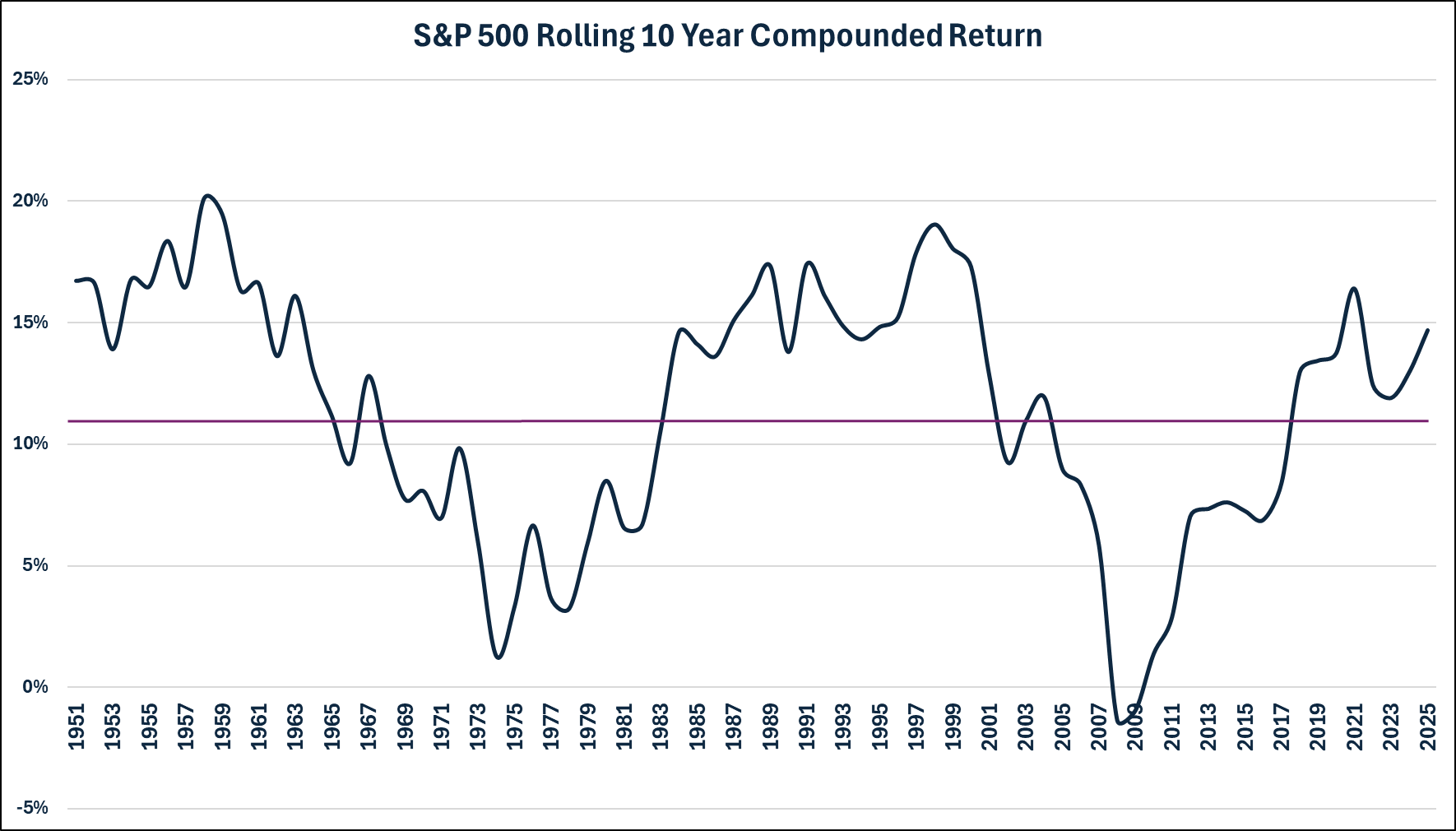

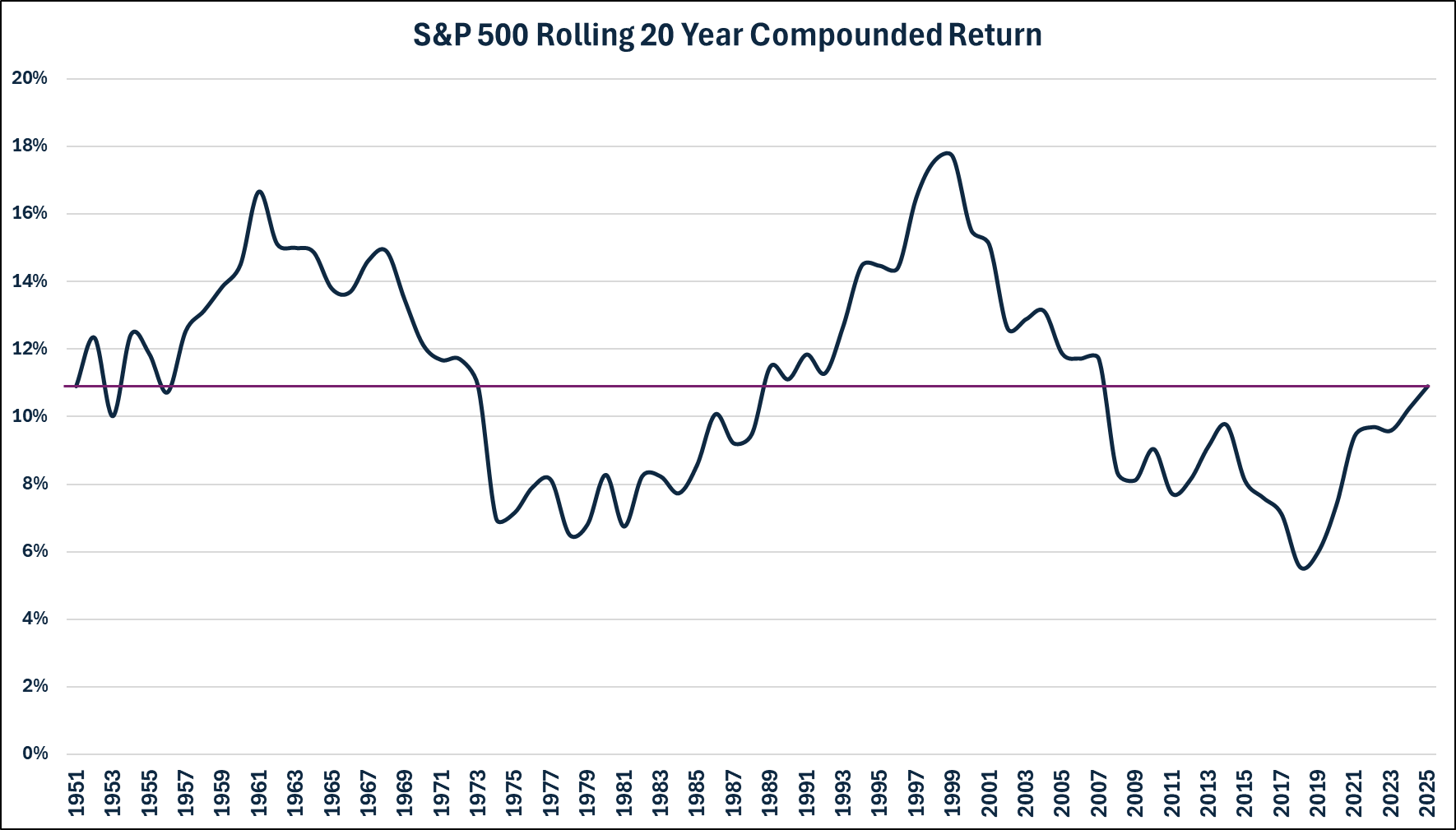

And for those worried about this particular time being a precarious entry point, whether it’s your first time investing or you just came into a large amount of money, I present some data below showing Long Term rolling returns of the US Stock Market.

For 10 year rolling returns, the average return since 1928 is 10.50%. Only 5 instances where your 10 year return was less than zero.

For 20 year rolling returns, NEVER has a 20 year return period been negative, and only three instances less than 5%.

For 30 year rolling returns, there have NEVER been returns less than 5% in the stock market.

So for anyone in and around my realm of life (37) or younger (!!!!), you need not worry about deploying money into the stock market. Just do it and in 20 or 30 years you’ll have ALOT more.

Real Estate

It has been almost a year since we found a solid value add investment opportunity.

The last one was a 244,000sf industrial building in Edmonton, which we bought at a +7% cap rate at below market rents. It has been a good performer so far and we like the industrial landscape in Edmonton.

Let’s see what 2026 has to offer.

Anyone interested in learning more about the value add investment opportunities we come across, please let me know.

1 Quote

“Slow and steady wins the race”

—Aesops fable 🐢

A Question

What are your financial prioirites for 2026? Let me know!