- The Goodwill Investing Journal

- Posts

- The Goodwill Investing Journal - Issue #101

The Goodwill Investing Journal - Issue #101

The Government Spending Loop - Why Your Money Buys Less. Stock Markets in 2025 Surprised Many. BC Government is Now Guaranteeing Loans?

Today’s Menu:

The government spending loop, and why your money buys less

Stock markets in 2025 surprised many

BC Government is now guaranteeing loans

Please share this Journal to anyone you think might find it helpful.

Happy holidays

Government Spending Loop

Society is made up of civilians and, in democratic countries, elected governments, in order to have organization and oversight over common services.

Basic examples are:

Legal: courts and judicial process

Infrastructure: roads, bridges, electricity

Emergency & Defence: ambulance, health, firefighter, police, military

Administration: citizenship, border security, record keeping

Financial: CRA, tax collection, financial support, canada pension plan, old age security

These things cost money to deliver. How do they get paid for?

Taxes → tax revenues collected from individuals and corporations.

Common taxes are:

personal income tax

sales tax

business tax

capital gain tax

property tax

estate tax

etc. (there are dozens)

The Government will present a “Budget” in the same way a regular person would:

Income: how much revenue (tax) they will collect

Expenses: how much they intend to spend

If Income is greater than Expenses (positive cash flow), that is a Budget Surplus.

If Income is less than Expenses (negative cash flow), that is a Budget Deficit.

More often than not, Governments are running Budget Deficits.

But how can someone spend more than they earn? By borrowing money.

The Government borrows money by issuing bonds. Essentially, investors ie. individuals, corporations, central banks & other governments, lend them money (buy their bond). In return, they promise to pay you back, with interest.

This works as long as you believe the government has the capacity to pay you back. Also as long as inflation doesn’t demolish the value of your future, fixed principal payment and interest.

The debt isn’t bad per se, just like with personal debt. It’s a tool - some is good, some is bad.

But it is always bad if it get’s excessive, because it becomes harder and harder to pay off.

And unlike households, governments seem to have endless support for borrowing more money - in part because they have a taxable source of revenue to call on (citizens), while a household can’t tax its pet cat to pony up more money. Indeed, homeowners would be bankrupt if they ran budgets like the government.

All of the above is what we call “Fiscal Policy” that governments are primarily responsible for.

Where is Canada at today? An excerpt from the Fraser Institute:

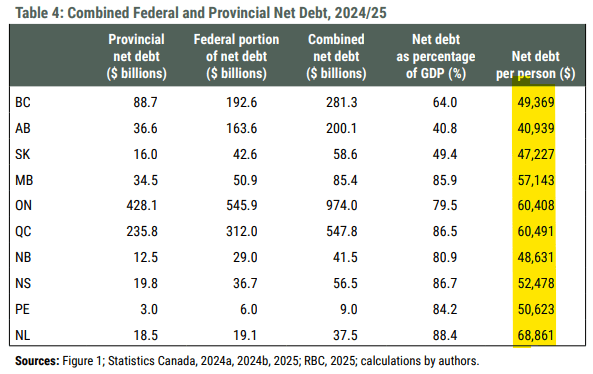

“Budget deficits and increasing debt have become serious fiscal challenges facing the federal and many provincial governments. Since 2007/08, combined federal and provincial net debt (inflationadjusted) has nearly doubled from $1.21 trillion to a projected $2.30 trillion in 2024/25.”

Side note… a simple way to understand how significant the world trillion is:

1 million seconds is 12 days

1 billion seconds is 32 years

1 trillion seconds is 32,000 years.

Trillion is a galactic level number, but we are both unable to comprehend it and/or are desensitized to it.

Why is this important to you and me?

Fraser Institute: “Rising government debt has severe consequences for Canadians as more and more resources are directed toward interest payments and away from programs that help families or improve Canada’s economic competitiveness.”

Larger debt and interest payments suck wind out of other important programs and increase the likelihood of higher tax rates later.

It also means government borrowing (the gravy train) costs more and the value of the currency in world terms declines as investors re-rate the country’s investment risk/reward merits.

What about the Central Bank?

The Central Bank is an “independent” (eye-roll) but accountable-to-the-government entity that executes “Monetary Policy”; setting short term interest rates and expanding or contracting the money supply (money printer).

New money gets injected into the system to keep the economy rolling or if inflation gets too high, they tighten monetary policy to slow it down.

More often than not, Governments are stimulating the economy, borrowing more money, and increasing the money supply.

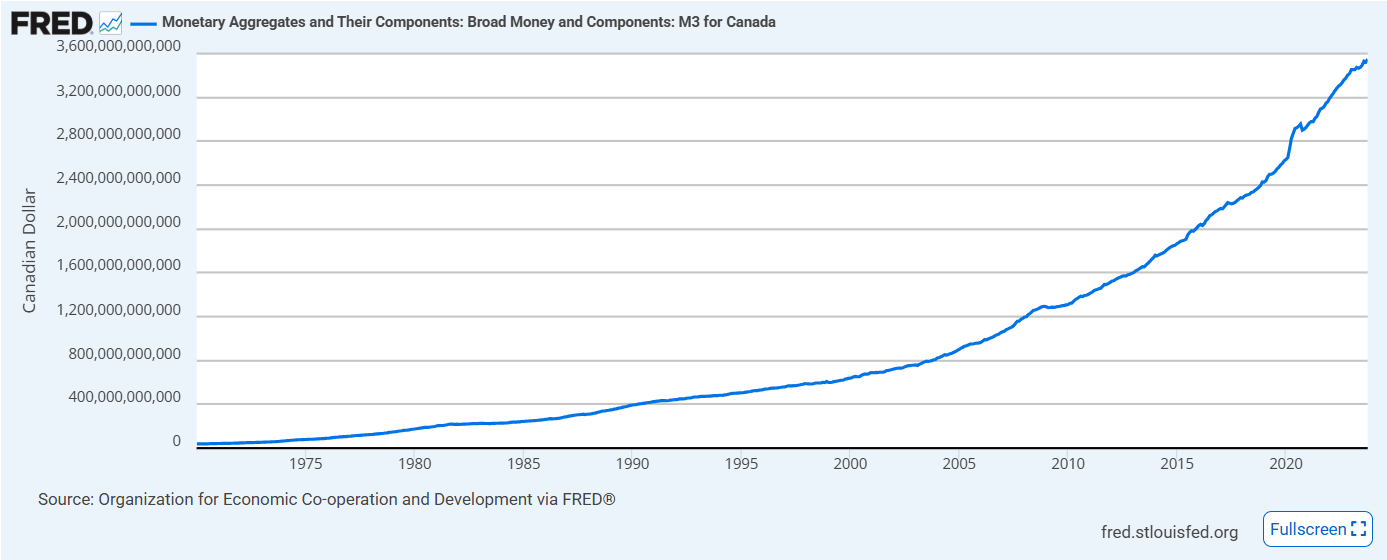

After nearly two decades of increasing deficits, rapid growth in government debt and expansion in the money supply, the value of your dollars have been declining faster than reported inflation figures because the government has printed more dollars at exponential rates.

In my opinion, CPI is a bogus indicator for regular people and instead you should be concerned about the money supply.

See Canada M3 Money supply chart below

And the same thing is happening in the United States, M2 Money Supply Chart:

M2 Money Supply

If your wages didn’t increase under the stimulus by as much as the money supply increased, you have been hit with the worst hidden tax of all: monetary debasement.

Anyone else notice that $100,000 of yesteryear goes nowhere? A recent viral post suggests $140,000 is now the poverty line. You can read the article here, make your own conculsions.

This is why we see so much divide between the “rich” and the “working class”, because those with financial assets based in dollars (ie Stocks, Real Estate, etc) have seen their wealth rise drastically, while ordinary folks living wage-to-wage and without investing accounts keep falling further behind.

And the ironic thing is, much of the political pressure for endless spending and more stimulus comes from the very group that is less capable of participating in the growth in financial assets!

Furthermore, most folks probably don’t realize this because it sounds abstract and falls into the “not my problem” camp, but government debt is directly related to us because it represents future claims on our livelihoods, either through higher taxes, inflation, or budget cuts!

See chart showing the combined government debt per person that we bear in Canada:

But just like a drug addict prioritizes that next high even with the knowledge it will shorten their lifespan, they hit that sweet crack pipe nevertheless.

And by the way, this isn’t a Left vs Right problem, both sides of the aisle spend more than they earn and borrow aggressively to fund those drug deals deficits.

So here goes the circle of life for governments and taxes:

People are pissed about their personal finances, demand change

Government promises services & big spending packages

People reward the spending because they see it as an immediate benefit

Expenses are greater than revenues and deficits have become normalized

Government borrows more money to pay for these deficits

Central bank keeps the gravy train going, money supply expands

Your purchasing power erodes, unless you have financial assets

Citizens feel poorer, again, get pissed, again, demand economic relief, again

Government promises more spending….!

At no point does the circle stop and yet the bill must still get paid, either through inflation, debasement of your money, higher taxes later, or reduced services later.

Always remember this, there is no such thing as a free lunch.

My personal advice - spend less than you earn & invest the difference, always.

Image created with Google Notebook based off the text above. AI is ok, but it ain’t perfect yet!

P.S. Ben Cherniavsky, former #1 Equity Analyst in Canada, encouraged me to write about this subject. I appreciate the idea and hopefully did it some justice. In the interest of sharing works, he has just authored a report titled: Canada’s Shrinking Stock Market Causes and Implications for Future Economic Growth. Some of you might find this interesting, I know I will!

Build wealth the way I actually do it

My ETF investing course walks you through the exact system I use—simple, low-cost, and built for real people with real lives. You’ll learn how to invest confidently without chasing headlines or picking stocks.

👉 Save 10% with code SIMPLYINVEST →

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

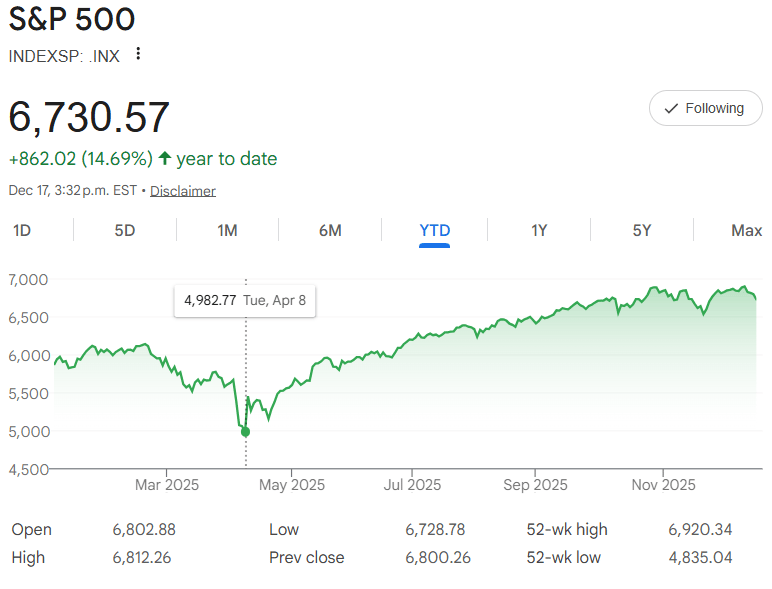

As we round out the year and given all that occured, one might be surprised to note how well the S&P500 has performed this year, up 14.5% not including dividends at the time of writing.

This follows +25% in 2024 and +26% in 2023.

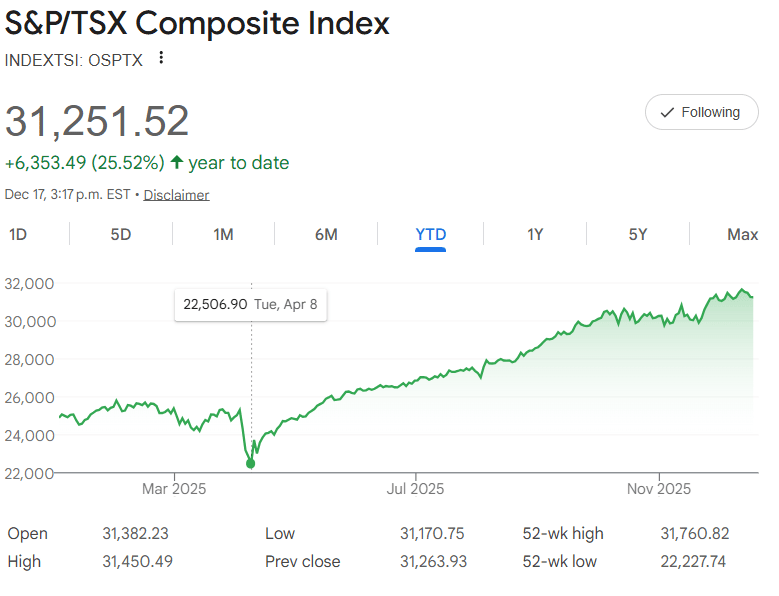

And despite all the political and tariff drama that led Canadians to be downright depressed about our prospects in 2025, one might also be surprised to note that Canada’s stock market index, the TSX Composite, is about to complete a near record year, up 25.5% not including dividends.

Congratulations to all that set aside the need to time the market and stayed invested through the news cycle.

Timing the market is a mugs game. No one can forecast what the market will do, so please shy away from anyone that is telling you to go all-in or all-out. They may get lucky once, but eventually will get wiped out.

Better to stick to your asset allocation, which represents your ability and capacity to take risk, and monthly automatic contributions.

You’ll do just fine.

Real Estate

Let me get this straight:

Private property owners pay taxes

They get Land Title certificate

First Nations claim that Land

Government does nothing

Homeowners Land Title is rendered uncertain

Mortgage financing dries up, sale prospects crushed

Government steps in with loan guarantees to support financing - potentially $1 Billion

Lending risk that banks used to bear is now borne by tax payers - you and me!

What the f?

1 Quote

“Fool me once, shame on you, fool me twice, shame on me. “

—Randall Terry

A Question

Anyone have additions or comments on the tax/government peice? Would love any feedback. It ended up longer than I would have liked but the goal was to make the largely abstract and complex topic accessible for all readers.

How did you like today's Journal? |

Reply