- The Goodwill Investing Journal

- Posts

- The Goodwill Investing Journal - Issue #103

The Goodwill Investing Journal - Issue #103

Three Factors That Determine Financial Success Or Failure. Einstein Was Wrong About Compound Interest. Real Estate Performance in 2025.

Happy new year everyone, greetings from Bali. Hope you are doing great.

I’m sure you all have lots of goals to get going on for 2026. As it relates to this journal, I am excited to keep writing, sharing and learning about money and finance and I hope to see more readers join the community, 1027 strong 💪. So, if you have been finding this letter useful, please do share with your friends and family.

Thank you,

Eddie

Personal Finance

There are three factors that determine financial success or failure:

Income - your responsibility

Spending (saving) - your responsibility

Returns - Portfolio Manager responsibility (you, if you DIY, or your Advisor)

Two beats one usually.

And if you buy the market consistently, you reduce impact of (3) failing you.

My friends know I talk a lot about diversified low cost ETF investing as a great way to invest – it is!

But, it’s not the only way to skin the cat.

You may have more experience investing in other asset classes – all the power to you.

But if you are:

just a regular human being

workin’ hard and focusing on your family

You can start investing better with a hands off approach by using broad based ETFs.

End of the day:

Be a Lion

Don't be a Gazelle

Build wealth the way I actually do it 🧠

My ETF investing course walks you through the exact system I use—simple, low-cost, and built for real people with real lives. You’ll learn how to invest confidently without chasing headlines or picking stocks.

👉 Save 10% with code SIMPLYINVEST →

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

Einstein once said compound interest is the eighth wonder of the world. I think he was wrong….

It is the first.

Let me explain…

Basically, when you invest, or lend someone money, you receive interest. Because a dollar today is worth more than that dollar tomorrow. This is the essence of Time Value of Money.

Invest $10,000 today at 10% interest, it will be worth $11,000 next year. Then $12,100 the next, then $13,310, then $14,641….

By year 20? $67,275.

By year 40? $452,593!

This is just one simple $10,000 investment.

Increasing the compounding frequency, your interest rate, or adding to your principal, can all help your savings grow even faster.

For those just starting out, adding to your prinicipal is hands down the most important to focus on.

For instance, if you can add an extra $10,000 every year there forward….Holy smokes. The value at year 40 is $4,900,000!

Not to take away from the other Wonders of the World, because yes they are incredible to be sure; I’ve seen couple in person and they are miraculous.

Sadly most people will never see any. Because they don’t have the time. Or in other words, they don’t have the money. Because, yes, time is money.

If you take a small amount of time today to truly learn of the power of compound interest, and implement it, harness it, you will find yourself with the Time and Money to actually go visit them, and anywhere else you feel so inclined.

Harness the first wonder of the world, then go see the rest.

On your own time. Instead of someone else’s.

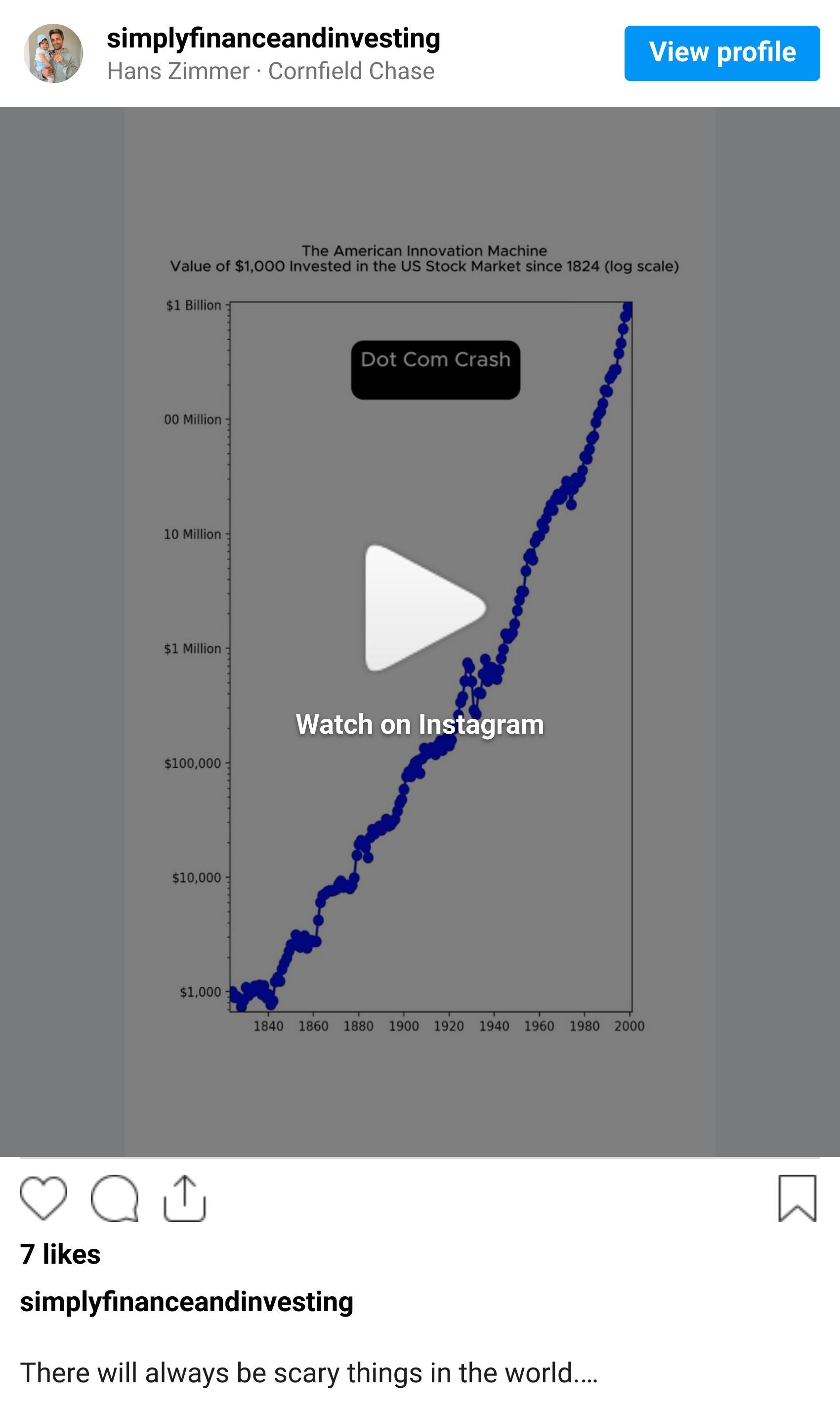

To see compounding in action over time, see this video I made of the American Stock Market since 1800s, where one $10,000 investment turns into $6,000,000,000.

The classic naysayer will say “oh but no one will live that long!!” Don’t listen to those Debbie Downers. The point is, start with 10,000 today and your future family may just be billionaires. Why wouldn’t you?

Real Estate

While the Canada and US broad stock markets have crushed it lately, the real estate sector has been a lagger for sure.

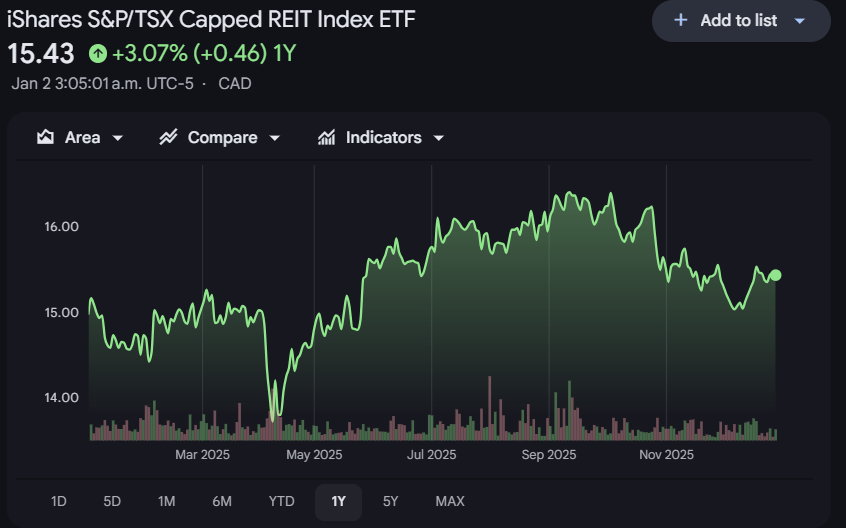

In Canada, the REIT index was up 3% in 2025:

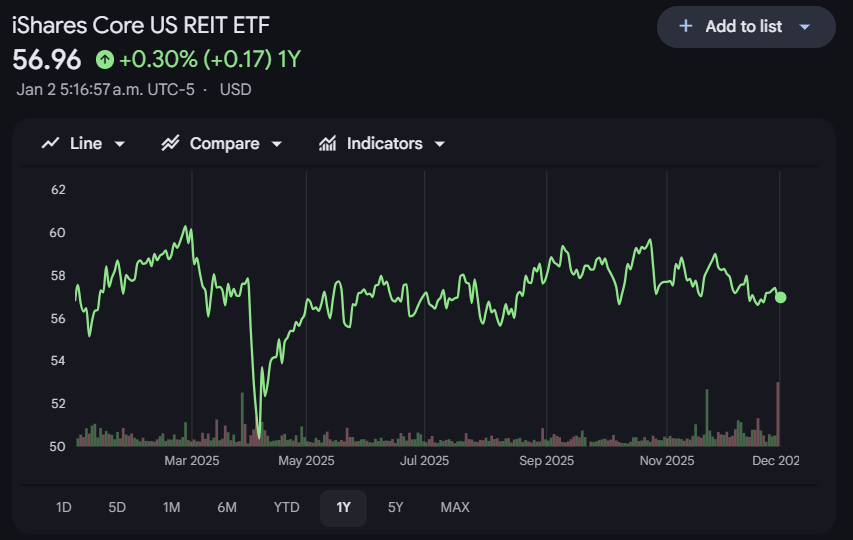

And in the USA, the REIT index was flat at 0.3%.

In terms of sector performance, retail has continued to shine, office has improved notably but still coming out of the depths, while industrial has pared back from its high’s and residential is getting beaten out back.

Not all real estate is created equal, and diversification is so important across sectors and geographies. Therefore your entry price is more important than ever, what is the execution plan, are you relying on (hoping for) some market forces to deliver returns or is there actual work you can do to add value.

These are the questions we consider (among many others) when we evaluate opportunities. Will see what 2026 brings.

1 Quote

“Ironically, common sense is the least common of all”

—Luciana

A Question

What is your top prioirty for 2026?

Mine: be the best dad and husband ever for our growing family.

How did you like today's Journal? |

Reply