- The Goodwill Investing Journal

- Posts

- The Goodwill Investing Journal - Issue #108

The Goodwill Investing Journal - Issue #108

Bitcoin is dead.

Good morning,

Had something completely different written this week but given the carnage in crypto particularly in Bitcoin, thought I would dedicate today to my personal-non-financial-advice thoughts about it. Sorry to those of you (the majority?) who are not interested in the subject.

Bitcoin

I’ve been Hodling Bitcoin since 2018.

You can see my previous commentary on Bitcoin from the past two years here.

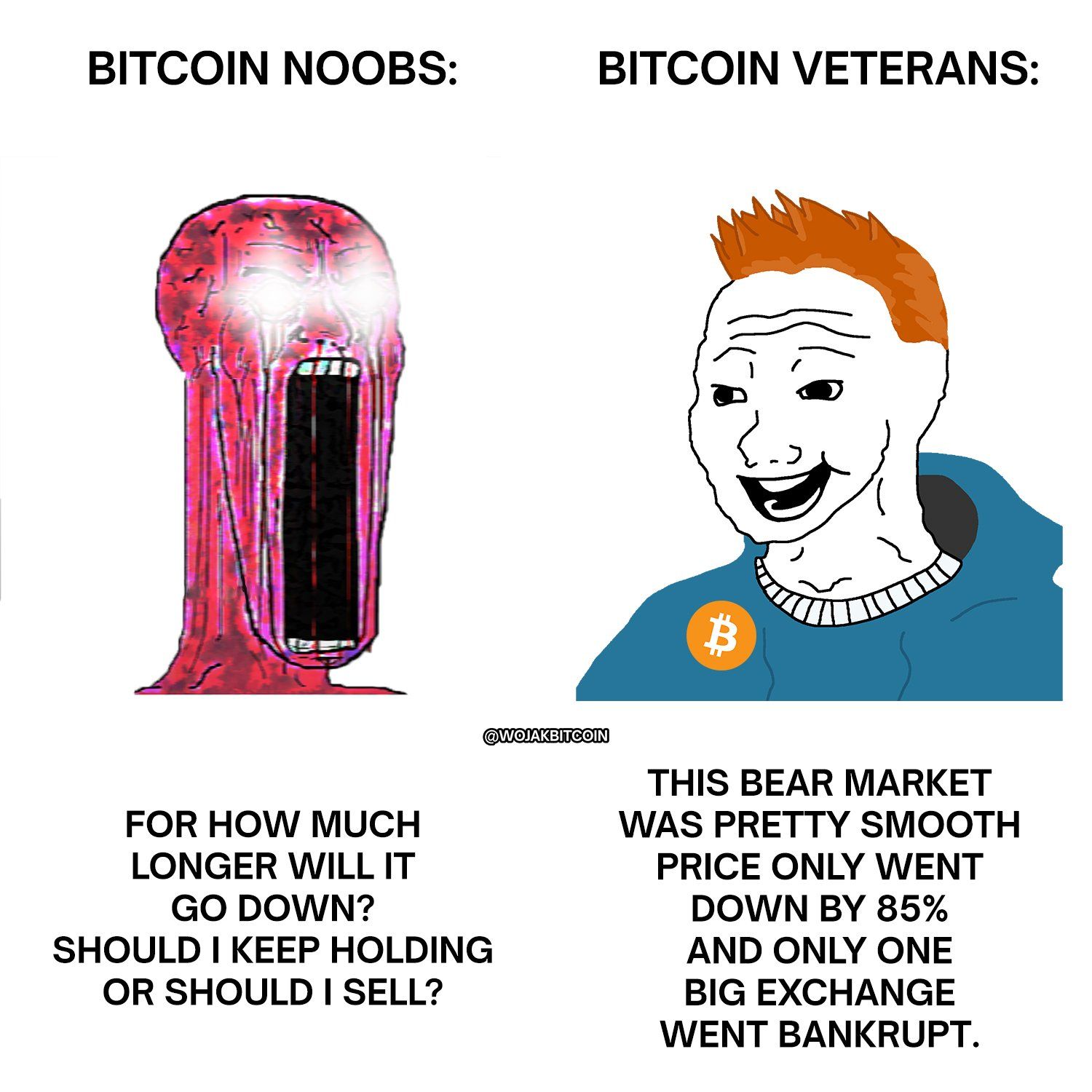

Over time and as I’ve learned more, I’ve consistently added to my Bitcoin allocation. During that time I’ve also built up the emotional ability to shrug off the 75% declines.

Because that is how the wind blows in the Bitcoin world. “Hodl” means hold on for dear life and is a good way to describe people who have held through previous crypto winters.

To me, and to others that have lived through the so called crypto winters, the long term view of the project outweighs any short term gut punches. And indeed we are in one of those gut punch phases right now.

Since the prior peak, Bitcoin is down roughly 50%.

The interesting thing for me to watch is sentiment. It feels like almost every Bitcoiner I follow is either nervous, defensive, or quiet.

I’ve had a bunch of people ask me what I think about Bitcoin - as if I’m an expert! Lol, far from it.

What I do know is that this is classic emotional support outreach as newcomers to the coin need someone to make them feel good while their portfolios scream at them.

A 50% drawdown will ALWAYS crush your soul if you bought near the top, sized the position too big, or worse, used leverage or borrowed money to buy.

People seem to forget about all the prior 80% drops. It’s par for the course.

The same thing always happens time and time again:

Euphoria - drawdown - doubt - fear - despair - capitulation - recovery.

So if you ask me, do I still like it at $69,000? Yes.

Could it go lower? Yes.

Do I know where the bottom is? Heck no, and neither does anyone else, no matter how pessimistic or optimistic they are.

If the long-term thesis plays out, whether the price is $50,000 or $100,000, these prices will look small in hindsight.

Post Script: I recieved this comment late and my response included:

“El peo es que eso no es como un compania que tiene un flujo de caja y un valor intrinsico... esa mierda se pudiera desaparecer” — if you don’t understand spanish, you all know how to use AI, go translate it.

My response:

Intrinsic value is subjective and ascribed. Fiat paper currency has effectively no value, except for the belief system behind the power and reliability of the government that issues it. Venezuelan Bolivar and the US Dollar are perfect and opposite examples - one destroyed and one is the world currency. Gold as well doesn’t produce cash flows, has no ‘intrinsic value’ except for its historical cultural belief that it’s rare and people find utility in wearing it to feel good. Yet it’s worth $4,900. Bitcoin doesn’t have cash flow either. But the unprintability of units and the utility of doing whatever you want with your money, whenever you want, with whomever you want, is the reason it is worth more than 0. I still cannot believe when I go to Scotiabank to send a $20,000 wire, they make me wait for 30 minutes (!) and ask me why I’m moving my money and for what purpose and to whom. Bitcoin solves all these issues. It’s by comparison just an embryo of course with only 18 years of history so volatility of 70-80% drawdowns should be expected….

Take good care out there and never over extend yourself.

Eddie

1 Quote

“Bitcoin has ‘died’ more times than Kenny from South Park”

—Anonymous

A Question

What is something about yourself that you are proud of?

ETF Investing Course

2-hour course that walks you through the exact system I use—simple, low-cost, and built for real people with real lives. You’ll learn how to invest confidently without chasing headlines or picking stocks.

👉 Save 10% with code SIMPLYINVEST →

🎁 Get $25 when you start with Wealthsimple. Use my referral code: PRGS3Q

Markets at a Glance

One Day % Change | YTD % Change | |

|---|---|---|

S&P500 | -0.17% | |

Dow Jones | 1.77% | |

Nasdaq | -1.96% | |

TSX Composite | 0.98% | |

Gold | 13.31% | |

Bitcoin | -24.52% |

Footnote: Price Data embedded from stocktwits.com. One day % change is based off the previous day’s close price vs price at time of publication.

How did you like today's Journal? |

Reply