Hey friends - I need some help!

Next week I’m meeting with the principal of a secondary school (my alma mater) to discuss teaching students about investing, money management, and financial literacy.

If you have ideas or suggestions on what topics would resonate most with young people, I’d love to hear from you. Reply to this email and let me know your thoughts!

PS. If you’re getting any value out of this Journal, please refer your friends to subscribe. I greatly appreciate it!

Personal Finance

There comes a time in everyone’s life when money becomes front and centre.

Not in your teens - because schools don’t teach it and nor do parents.

Either rich parents over spoil, or middle/lower class simply ignore the subject.

Not in university - when any money earned equals beers and girls (or boys).

Not in your early 20s - when it’s all about the next Vegas vacation and hitting three night clubs a week.

No.

Somewhere in your early to mid 30s is when it becomes well apparent that without more money, you’re gonna struggle big time with life in general.

Retirement prospects

Enjoying things that cost money

Building a family

Health

Nothing in life is free - including your time. So use it wisely:

Start saving, investing, and spending consciously

Don’t waste money on useless crap

Be a lion, not a gazelle

Start now

My life has always been about money - it’s the career of choice for me - but even more so now with a young daughter, a family to care for, and lots fun to have.

That’s it.

💝 Newsletter subscribers get 10% off the Simply Investing course with the code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

You hear a lot about ETFs in this Journal - so it’s about time we go through one, step by step. Below is a series of snap shots taken from iShares.ca with my commentary. Hope this is helpful.

Things you need to know.

XSP - this is the ticker symbol - what you actually type on the computer, or your iPhone, to buy the ETF.

ETF means “Exchange Traded Index Fund” - in other words, with one investment, you own a basket of stocks, these being the 500 stocks in the United States S&P500 Index.

NAV, or Net Asset Value, is priced at $60.46 - this is the current price of one share of the ETF.

Objective - seeks long term capital growth by replicating the performance of the S&P500 Hedged to Canadian Dollars Index, net of expenses. This exposure is also available unhedged in XUS.

They even tell you why: own a diverse portfolio of 500 US Large cap companies while hedging currency. Low Cost. Designed to be a long term core holding.

Performance.

You can see average annual returns of the ETF vs the Benchmark index.

They are slightly lower than the benchmark because of the cost for iShares to actually make, market, distribute, rebalance, and manage this index fund.

10 year total return is 11.54%. That means $10,000 invested tripled to $30,000.

This is net of all fees.

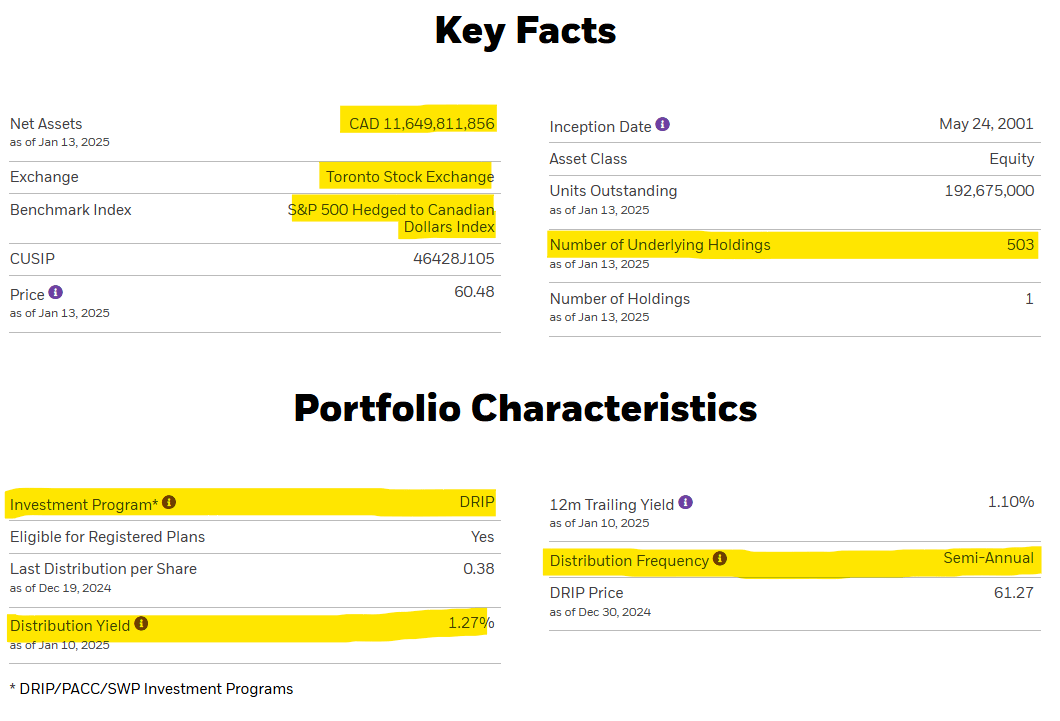

Key Facts and Portfolio Stats.

Net assets of $11.6 Billion Dollars - this is a very large and liquid fund.

Exchange - it trades on the Toronto Stock Exchange, so if you have Canadian dollars to invest, such as in a TFSA, this is a great investment vehicle.

You can see it has 503 underlying holdings - again, these are high caliber publicly traded stocks in the United States.

Distribution yield - it currently pays 1.27% distribution, every 6 months. Why isn’t it higher? Well, because most of the stocks in this index are in growth mode and prefer to reinvest cash profits into their businesses. This is good.

DRIP - Dividend Reinvestment Program - meaning whatever dividend payout there is, you can select to have it automatically re-invest those payouts to buy more shares of the ETF - I highly recommend doing this.

Also worth mentioning is the average Return on Equity for this index is 28% - meaning every dollar of equity these companies have invested earns 28% on average - this is a very impressive number.

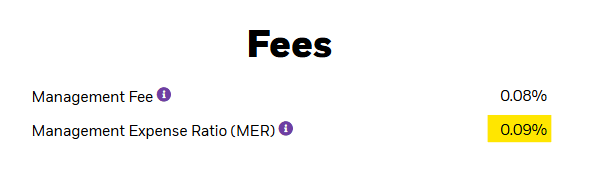

Fees.

Management Expense Ratio - this is the total cost to the investor - you.

It is 0.09% per year. To invest $10,000 it costs you $9.

This is a great product for a

stupidly lowphenomenal price.

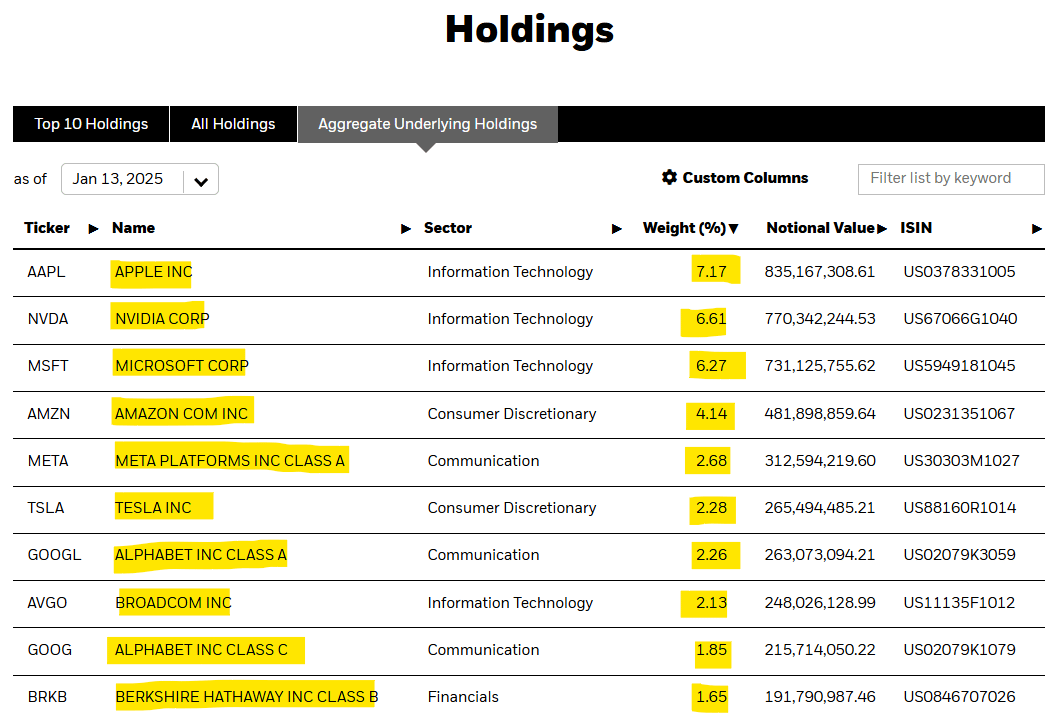

Holdings.

Here you can see the top 10 holdings

Usual suspects like Apple, NVIDIA, Microsoft, Amazon, etc.

Even Berkshire Hathaway, Warren Buffet’s company, is in the top 10.

Side note - Warren Buffet is the greatest investor of all time.

Plus 493 other great American companies.

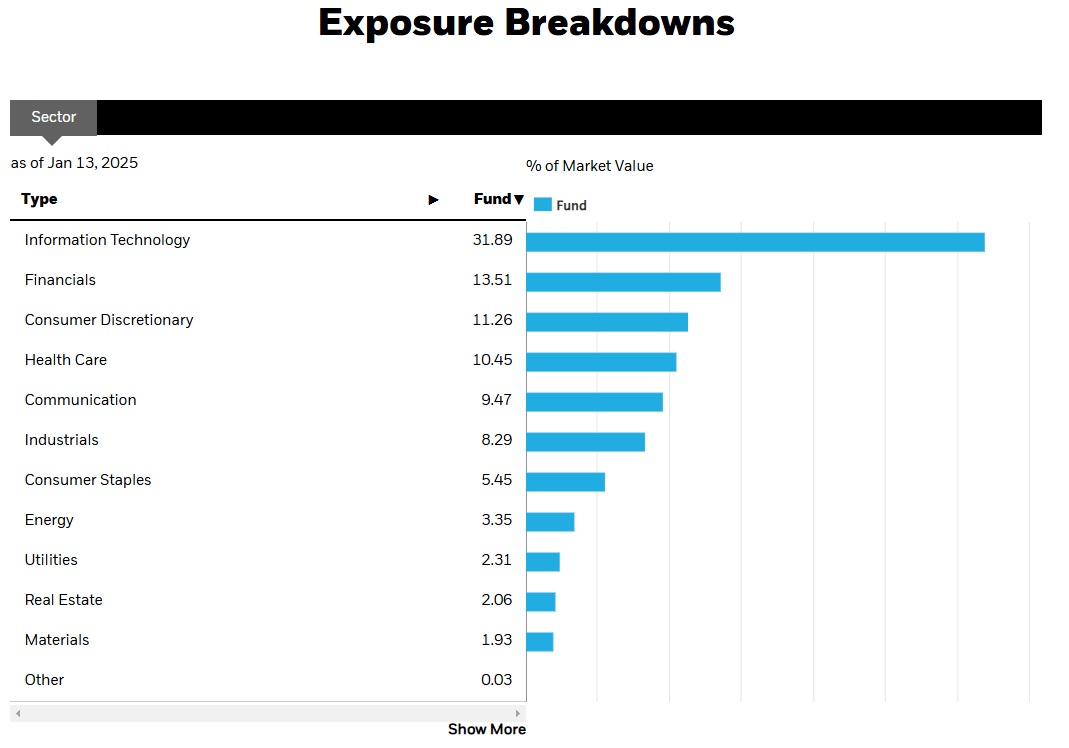

Sector Exposures.

Here you can see how much is in Technology - 32%

It also has exposure to Financial (banks/insurance companies), Consumer Discretionary (think retail companies), Industrials, Energy, even Real Estate and Gold.

Final Thoughts.

ETFs are one of the best inventions ever made because they give ordinary people a chance at being extraordinary investors.

Indeed, 90% of hedge funds—“the pros”—underperform the S&P500 over the long term.

Only a few decades ago you would have to buy a whole bunch of stocks individually and pay a fat commission to do so, sometimes as high as 5-10% of each purchase. Then you would have to rebalance each position as performance for each stock varied in your portfolio. Here you take individual stock picking risk, which is exceptionally hard.

Today, with your feet up on the couch, you get to buy an index of 500 amazing stocks, with one click and at a near zero cost.

By the way, if you are a US investor, you can buy IVV. And if you are in the United Kingdom and want to buy the S&P500 with Great British Pounds, you can buy GSPX.

Hope this is helpful.

Real Estate

Unless you are in the real estate business day to day, most probably don’t understand how much work it is to buy a $30,000,000 commercial property.

Sourcing the deal, networking with brokers

Submitting Letter’s of Interest, negotiating Purchase and Sale Agreements

Performing market, financial, and property analysis

Synthesizing this into proforma projections

Creating investment memorandums

Raising equity capital and managing all the investor subscription documents and deposits

Securing bank financing (mortgage) and all the requirements to satisfy the bank conditions

Accounting, budgeting, verification of vendor’s financial books and recovery methods

Review of Building Condition reports, Environmental Issues

Legal requirements, setting up bank accounts, understanding and complying with city codes

Etc.

There is so much to cover in order to complete a transaction - not to mention the actual property, leasing, and asset management once you take ownership.

In commercial real estate land, it’s standard to have “conditions” in your purchase agreement - basically ensuring you have all the necessary time to complete due diligence to your satisfaction - because you are investing a lot of money!

Unlike the residential market - especially in places like Vancouver during a hot market - we have seen many times in the past where buyers would make offers on property WITH NO SUBJECTS.

This is crazy to me - because often a principal residence is likely the biggest purchase someone will ever make.

Next time you go looking to buy a property, please be sure to include a subject to inspection and financing. This will give you time to also perform a proper market and neighborhood analysis. Go knock on your neighbors doors. Get an inspector. Does the roof need to be replaced? Are there rats? Seriously, the place beside me just sold and the new owner is already dealing with a rat problem in the attic and having to do roof work at the same time - imagine how punishing that would feel. They have a great view though!

Talk to other realtors - not just the one selling you on the purchase. Otherwise you could find yourself in a precarious position if you find out you bought a lemon.

1 Quote

Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.

A Question

Do you own the S&P500? Why? Why not?

_____________

If you enjoyed this issue, please forward this email to your friends to subscribe.

Thank you

Eddie Gudewill, CFA

How did you like today's Journal?

Investing Course

If you want to learn everything you need to know to be a great investor, consider my self guided ETF investing course.

Customer review:

"Hey Eddie - your course is precisely what I have been missing and has been so helpful in giving me more confidence to invest myself" - 30 year old MBA student.

What you get

✓ 2 hours video content

✓ Take at your own pace

✓ Training by a real portfolio manager

✓ Excel templates i.e. budget, retirement calculator, rebalancing spreadsheet, and more

✓ Unlimited lifetime access, and all future updates at no cost

✓ 100% money back guarantee. If you don't like it, let me know and I'll give you your money back.

I'm trying to make you a millionaire - not sell you some junk.

You will transform from being unclear and apprehensive, to a capable and confident investor.