Hi everyone, today we start with a $300,000,000 Ponzi Scheme and the importance of managing your emotions. Then a discussion on Warren Buffet, and finish with some thoughts on breaking into commercial real estate.

Also, if you are enjoying this journal and you think someone might benefit from reading it, please share.

Thank you, Eddie

Personal Finance

Everyone wants to get rich—good, me too—but how?

There are good, bad, and ugly versions:

The Good: earn more, spend less, invest the difference.

The Bad: day trading, timing the market, multi level marketing.

The Ugly: gambling, selling drugs, ponzi schemes.

Selling drugs? Sure thing, until you go to jail, or get shot.

Gambling? The allure of fast money is enticing, but the odds are stacked against you, and the house always wins. (By the way, it’s absurd how quickly this industry is growing and ruining peoples finances. Not sure how all the TV advertisements are even legal).

And then there are Ponzi Schemes. These are interesting because they can appear like “legit” investment opportunities, but are entirely fake.

I bring this up because earlier this week my friend reminded me of one of the biggest frauds in recent Canadian history, which also happens to come out of my hometown, Victoria, BC.

Enter Greg Martel, who ran My Mortgage Auction Corp. (MMAC), claiming to offer safe, high-return investment opportunities.

Martel claimed (pretended) to be funding loans for real estate buyers, and investors in these loans were promised high returns on their investments.

But no real loans ever existed. Instead, $300,000,000 vanished. Lives were destroyed.

And this dirt bag lived like a king, until it all collapsed:

Personal expenses: $5.5 million (luxury goods, meals, entertainment).

Travel & private jets: $4.3 million.

Credit card/interest payments: $18.4 million.

Stock trading losses: $27.1 million.

Business expenses: $33.8 million (including failed projects like "Shair Your Car").

Vehicle-related expenses: $3.7 million.

In effect, preying on people’s greed, this absolute POS sucked in investors with promises of big & safe investment returns. Instead, 1,709 victims have seen their lives wrecked and savings go bye-bye.

So, you might be wondering, how does this relate to personal finance?

Well, as much as the wealth game is about learning how to earn, save, budget, invest, etc, equally important is managing your own emotional relationship with money.

Next time you find yourself impulsively chasing the next hot investment product, slow down, ask a friend for help, try and be objective, understand the risks and rewards, don’t put all your chips on the table, and be on the lookout for red flags (i.e. private jets & yachts on Instagram).

In sum, there are no get rich quick schemes—unless you want to go to jail. No, creating real, sustainable wealth requires emotional control, patience and time. That’s when the real magic of compounding happens.

Aesop’s fable is legend for a reason. The Tortoise always wins.

PS. Martel is still a fugitive at large. Hope they get him soon. Here is a sample screenshot from the affidavit - which is full of incredible, unbelievable information.

💝 Newsletter subscribers get 10% off the Simply Investing course with the code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

Instead of opining on why stocks, crypto and just about ever asset class is down this week, I’d like to share with you Warren Buffet’s annual letter to shareholders. Humbly speaking, Warren Buffet is the world’s greatest investor, period.

His company, Berkshire Hathaway, is the 7th largest company in the United States with a value of $1,000,000,000,000 ($1.0 Trillion).

Buffet, being the majority shareholder with 15% ownership (and 39% voting rights), is worth $150,000,000,000 ($150 Billion) and is the 7th richest person in the world.

This is an astounding feat, for he has not done this by being an innovator, founding a tech company, nor through real estate (he still lives in the same house he bought for $31,000 in 1958 in Omaha, Nebraska).

No, Buffet is the only person in the top 10 that is purely a stock picker—meaning, buying shares in existing businesses and letting the founders & management teams continue to run them as they see fit, for a really long time.

His overall compounded return? 20%.

20% may not sound like a lot—especially when someone quotes you how much NVIDIA went up last year.

But over time, 60 years in fact, 20% is by far the most impressive long term return that any investor has ever achieved.

Put another way, 20% compounded for 60 years equates to a 5,000,000% overall return, where a $10,000 investment turns into $550,000,000.

Buffet is one of my true idols for more than a few reasons. His track record is simply stunning, he has a way of simplifying the complex, invests in durable businesses he understands, with people of high integrity, and has an unmatched objective and calm demeanor. But most of all, he’s humble while he does it.

He commonly attributes his success to the people that actually run these business, readily owns up to his mistakes, reminds people he wouldn’t have been anywhere near as successful without the help of his partner, the late Charline Munger, and the simple fact that he was lucky to be born in America.

He also commonly rips on Wall Street antics; he dislikes investment bankers and has stated in the past he has never used their services. He can’t stand the fake adjustment numbers that the investment industry comes up with, like EBITDA or Earnings before interest, taxes, depreciation and amortization. He prefers to use simple Operating Earnings—the true measure of performance as well as focusing on return on equity.

Focusing on durable businesses (think railroads, insurance), he always reminds us that it is “far better to buy a wonderful company at a fair price than a fair company at a wonderful price”, and his favourite holding period is forever.

He often likens investing to baseball, only the rules are slightly different: in investing, you don’t “strike out” if you choose not to swing. So Buffet prefers to be patient, swinging at only the fattest pitches that come his way. This is where real “alpha” comes from.

Side note: y’all know I hammer home ETF investing, but if you are going to be a stock picker, I suggest you try and emulate Buffets approach. Otherwise, Buffet himself has suggested most people simply buy and hold index funds, and for good or bad, never bet against America.

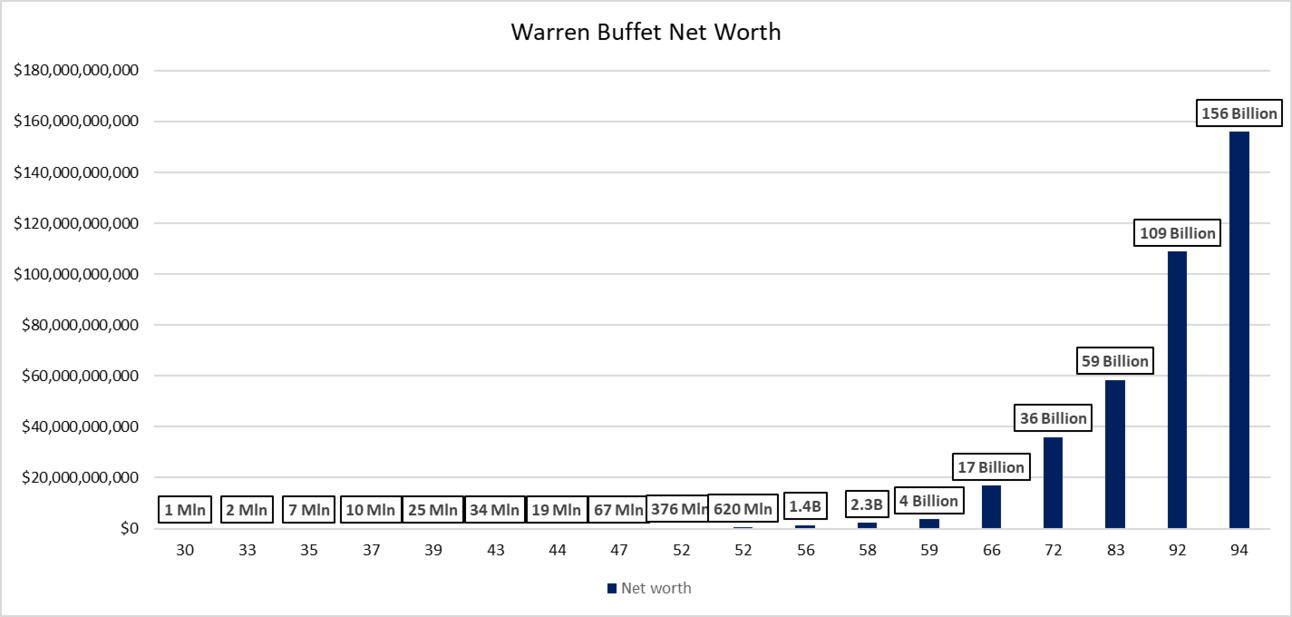

Buffet may be worth $155 billion at age 94, but did you know that $150 Billion of that came AFTER his 60th birthday?

He went from a few million net worth in his 30s, to $5 Billion by 60 - a 1,000 fold increase in net worth. Incredibly impressive.

For him to go from $5 billion to $150 billion is “only” a 30x fold increase in his net worth. But because of compound interest, the latter performance VASTLY dwarfs the first 30 years of his investment career in terms of actual dollars. So much that those early years, despite the “RETURNS” being far greater initially, the chart barely registers during that time period.

This highlights the power of time and compound interest.

If you don’t know much about Warren, suggest you read up or YouTube him.

To close, here are some select quotes from his letter:

“During the 2019-23 period, I have used the words “mistake” or “error” 16 times in my letters to you. Many other huge companies have never used either word over that span”

“Sometimes I’ve made mistakes in assessing the future economics of a business I’ve purchased for Berkshire – each a case of capital allocation gone wrong. That happens with both judgments about marketable equities – we view these as partial ownership of businesses – and the 100% acquisitions of companies. At other times, I’ve made mistakes when assessing the abilities or fidelity of the managers Berkshire is hiring. The fidelity disappointments can hurt beyond their financial impact, a pain that can approach that of a failed marriage.”

“One further point in our CEO selections: I never look at where a candidate has gone to school. Never!”

“Not long ago, I met – by phone – Jessica Toonkel, whose step-grandfather, Ben Rosner, long ago ran a business for Charlie and me. Ben was a retailing genius and, in preparing for this report, I checked with Jessica to confirm Ben’s schooling, which I remembered as limited. Jessica’s reply: “Ben never went past 6th grade.”

“As Charlie and I have always acknowledged, Berkshire would not have achieved its results in any locale except America whereas America would have been every bit the success it has been if Berkshire had never existed.”

“This system is called capitalism. It has its faults and abuses – in certain respects more egregious now than ever – but it also can work wonders unmatched by other economic systems.”

“Sixty years ago, present management took control of Berkshire. That move was a mistake – my mistake – and one that plagued us for two decades. Charlie, I should emphasize, spotted my obvious error immediately: Though the price I paid for Berkshire looked cheap, its business – a large northern textile operation – was headed for extinction. The U.S. Treasury, of all places, had already received silent warnings of Berkshire’s destiny. In 1965, the company did not pay a dime of income tax, an embarrassment that had generally prevailed at the company for a decade. That sort of economic behavior may be understandable for glamorous startups, but it’s a blinking yellow light when it happens at a venerable pillar of American industry. Berkshire was headed for the ash can. Fast forward 60 years and imagine the surprise at the Treasury when that same company – still operating under the name of Berkshire Hathaway – paid far more in corporate income tax than the U.S. government had ever received from any company – even the American tech titans that commanded market values in the trillions.”

Real Estate

Had a call with a 25 year old hockey player this week looking for advice about breaking into real estate.

He will play a year of pro after graduating but is smartly tooling up now so that he can hit the ground running when he “retires”.

My venture into real estate wasn’t exactly traditional. From a CFA designation, to sell side stock research, to high net worth portfolio management, it took me 13 years to make the switch.

Not that the business model of Portfolio Management isn’t good. It’s great actually. But the day to day of wealth management is starkly different than it was a couple decades ago.

There is far less value in “stock picking”—as we’ve seen much evidence of how hard it is to “beat the market”. And so managing high net worth money for the most part is about making broad asset allocation decisions, often using ETFs to get exposure, financial planning, tax planning, and being a shoulder to cry on. Boring!

I’ve always liked the business of real estate private equity and was fortunate to get exposure over the years leading up to the switch (part of our portfolio at Richardson was invested in private real estate).

Also I like the fact I get to interact with a fewer number of investors (many of whom are highly sophisticated) while hunting with a sniper rifle for one or two new deals a year. In many ways it’s like evaluating a small cap stock, it’s all about figuring out the cash flow and upside potential of the investment.

So that’s a background on why I made the switch. And by the way I don’t regret the path I took to get here one bit. The capital market experience and relationships I’ve been blessed with have proven invaluable.

But if I knew from the outset, like my new friend Reid here, that I wanted to begin my career in the commercial RE business, I would consider these ideas:

Look at high quality brokerages to start (Colliers, CBRE, Avison, JLL, etc). The scale and variety of exposure you get from one of these institutions from the ground up is astounding. You learn deal structure, marketing, leasing, develop wide knowledge areas and contact networks.

Reid likes building and has worked in construction, so maybe he could consider getting on at a Development company instead. Go for the high quality, well known firms if possible to start.

Level up financial modelling/excel skills. End of the day it’s all about how you evaluate cash flows and identify value, whether you are providing a client an opinion of value, or buying a piece of land and building a tower. There is a great website called Adventures in Commercial Real Estate with accelerator courses and hundreds of free excel models.

Remember that RE is all about relationships. If you are a broker, buyers and sellers of properties need to trust you in order for you to get the listing. If you are syndicating Limited Partnerships like we do, your reputation and investor capital is the most precious thing you have. And, unlike the stock market, where price information is readily available, real estate has no real-time price. So having a Rolodex of knowledgeable contacts is essential when determining value and ultimately making real estate investment decisions.

Finally, you have to be both competitive—work for wins and take losses in stride— and likeable. No one will hire or work with a crusty know it all. Managers want to see that you are eager to learn, have a can do attitude and also view your potential as a future leader. First five minutes on the phone with Reid, who is also the captain of his varsity hockey team, and I can already tell he has the right qualities for this business.

Any RE folks reading this, would love to know your thoughts if you have anything to add that I can pass along to Reid. He’s also looking to make some new connections so anyone willing, let me know.

Thanks!

1 Quote

Slow and steady wins the race

A Question

Polling the audience: who has / has not heard of Warren Buffet?

_____________

If you enjoyed this issue, please forward this email to your friends to subscribe.

Thank you

Eddie Gudewill, CFA

How did you like today's Journal?

Investing Course

If you want to learn everything you need to know to be a great investor, consider my self guided ETF investing course.

Customer review:

"Hey Eddie - your course is precisely what I have been missing and has been so helpful in giving me more confidence to invest myself" - 30 year old MBA student.

What you get

✓ 2 hours video content

✓ Take at your own pace

✓ Training by a real portfolio manager

✓ Excel templates i.e. budget, retirement calculator, rebalancing spreadsheet, and more

✓ Unlimited lifetime access, and all future updates at no cost

✓ 100% money back guarantee. If you don't like it, let me know and I'll give you your money back.

I'm trying to make you a millionaire - not sell you some junk.

You will transform from being unclear and apprehensive, to a capable and confident investor.