I Gazelled this week.

For new readers of the Journal, you may need to read this primer on the Lion vs Gazelle to understand.

Got myself a WHOOP. A wearable on your wrist that has biometric tracking, ECG, heart rate, VO2 max, sleep, recovery, stress indicators, etc. Or so it says….

My cousin has a WHOOP and speaks highly of it.

It got a one month free trial, then its $250/year.

Gazelle? Or Lion move?

If you are enjoying the Journal, please forward to your friends to subscribe.

Personal Finance

Do you mortgage the house purchase and keep some cash in your investment portfolio? Or pay for the house in cash?

One argument says buy the home in cash—this could be called less risky from a leverage perspective, no burden of a debt overhang, and it can make for less stressful ownership. You still have property taxes, maintenance, insurance, but no mortgage payment. The drawback is you’ve depleted much, if not all, of your liquid investments (homes in Canada are expensive), so you forego investment returns in other assets, and your liquidity—your optionality of choices—is limited.

The other side of the equation would argue that leveraging your cash into a larger-sized asset can magnify your return on equity handsomely. If you put down 20% on your home, that’s a 4 to 1 equity multiplier (80% debt / 20% equity = 4x). If the housing market goes up 5%, your equity goes up 4 × 5% = 20%. The drawback is you are beholden to a bank who owns 80% of your home, and you are on the hook for that large mortgage payment, no matter what. This can be emotionally hard to deal with.

However, one of the other advantages is that by using some debt to buy the house, you haven’t used up 100% of your cash, and therefore you are able to invest and maintain a liquidity pool that gives you flexibility elsewhere. The cash could be invested in stock markets, which go up 8–10% on average. Or it could be kept in high-yield savings products earning interest, which could represent your emergency fund, get-out-of-jail card, or opportunistic capital to deploy when and if the proverbial bear markets take hold (this takes skill to identify when that happens of course, and more importantly, acting with conviction when that does happen).

There’s no perfect answer to this debate because it relies on many assumptions about the future:

What is the level of interest rates?

How expensive are homes in your area, are they over/underpriced?

Will house prices grow with inflation?

Will they outpace stock markets? Typically they don’t over long periods of time, but there are certainly examples like Vancouver in the decades past where periods of record home price appreciation minted many millionaires that used leverage.

What if they go down? Recent reports show declines of 15-20% in Vancouver and Toronto recently (real estate is local, stocks are global).

What is your emotional readiness to handle a mortgage and manage your investment portfolio, vs. owning a house outright but having no emergency fund on the side?

What is your income level now? What happens if you lose your job?

How about tax? Capital gains on primary residences are tax free but taxed on stocks (save for TFSAs and RRSPs etc).

What if the government eventually starts taxing primary residences? Hopefully never, but nothing is forever.

Too many factors to list, but you get the idea. Also important to remember is your house is not a productive asset—you cannot spend it, nor does it send you dividends.

Usually it depends. I’ve been renting for over a year, so I’m not even in this game at the moment (it’s been a really, really nice change FYI). But at some point, I will buy another home. Not insanely expensive, and I will use a mortgage, but reserve a healthy portion of cash in my investment portfolio for emergencies and optionality.

Optionality being the key word here. Borrow enough to improve returns, but not too much that I’m feeling pinched, while keeping enough invested in the stock market to grow.

What about you?

PS. Don’t let a mortgage broker convince you to take a $1.7 million mortgage on your $200,000 of income because he says he can get it for you—you’ll get completed wiped out while he gets a fat commission. Seriously, people like this exist—selling you massive mortgage products for selfish reasons but with no care for you as a person. If you want a GREAT mortgage broker, that will actually take the time to understand you and place you into the right mortgage, I know a great one, happy to refer 👋.

💝 Newsletter subscribers get 10% off the Simply Investing course with the code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

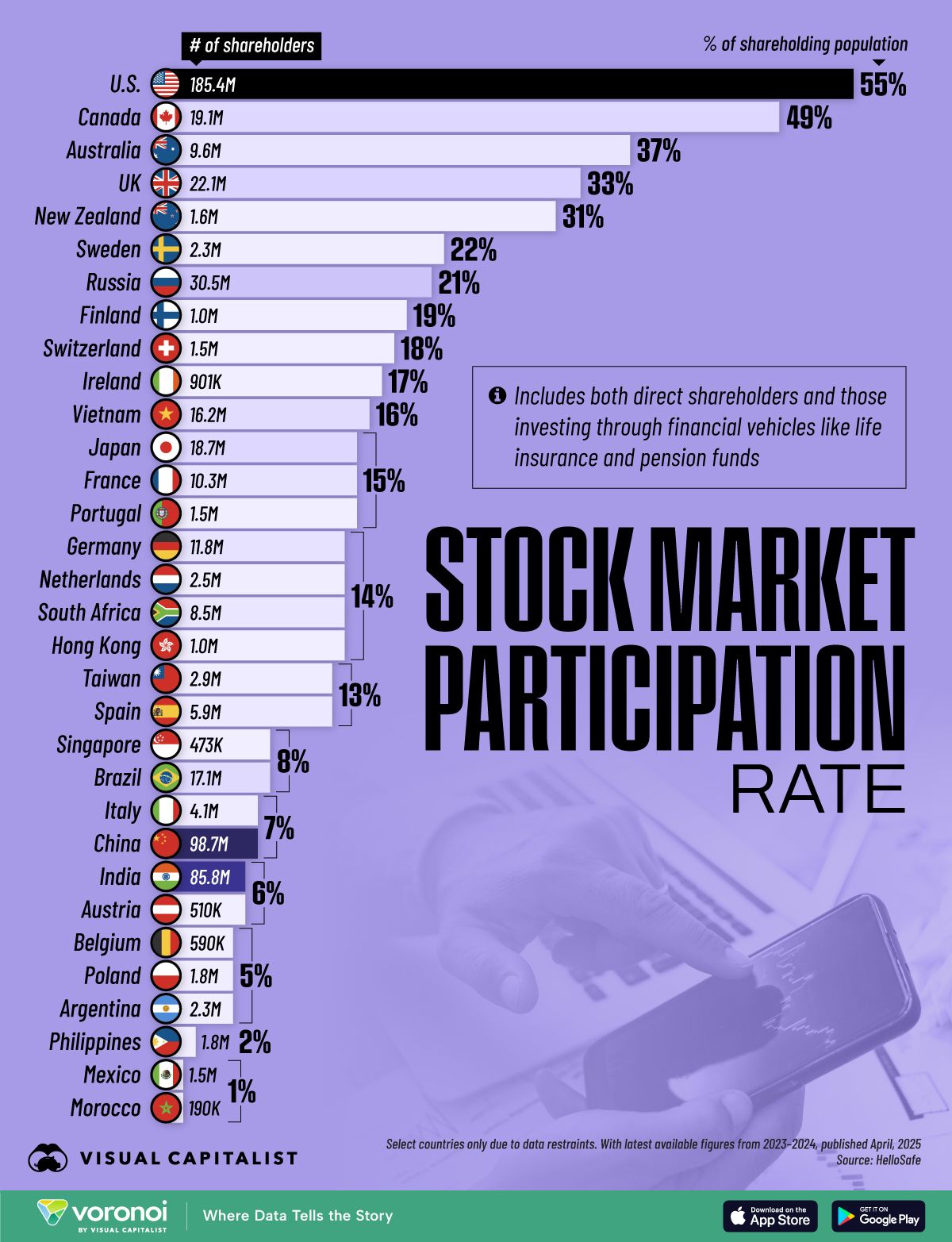

Very interesting Chart from Visual Capitalist, showing the stock market participation rate in major economies.

Canada, we are doing great. Right up at the top at 49% participation, while the US unsurprisingly is leading at 55% of the population.

This doesn’t mean everyone is actively owning stocks or ETFs, as a good chunk of this comes via people’s pensions and within insurance portfolios.

Nevertheless, it’s great to be at the top.

However, there is more work to do. With smartphones and mobile investing apps like Wealth Simple, this number should be way higher.

The greatest wealth building tool known to mankind (aside from our brainpower and efforts to make something happen), is the stock market, particularly, Exchange Traded Funds that make it as easy as driving a car.

Everyone should be doing it.

Thankfully, I’m quite certain most if not all of you long time readers are investing in the stock market. I’d hazard to guess at least 80%, with 20% about to start.

Real Estate

Edmonton: bullish.

Couple notes from the conference:

The story is affordability which is bringing a lot of young families to the province, economic opportunity, the jobs are there, and upward mobility is possible. This trend has years to run.

Calgary has seen its run up and things appear to be stalling there. When real estate runs, the affordability advantage starts to dissipate. Home prices there are about $660,000 vs Edmonton at $460,000.

Ditto for industrial rents in Calgary which are now mid-high teens and catching up to Vancouver and Ontario. Edmonton meanwhile average rents are $10-12, attracting more businesses.

BC and Ontario are experiencing challenging real estate markets and broad economic challenges (particularly Ontario which appears to be getting badly hit by the recent Tariffs).

It was noted that Edmonton, and Alberta will likely fare the best in the world of Trump Tariffs - hopefully so.

Edmonton industrial market becoming a more diverse tenant base.

Vast range of users vs historical economy.

Transportation network through Edmonton is astounding.

Small to medium bay industrial is very strong, much more active than mid/large bay

Industrial rents are moving up. Developing small bay for smaller tenants is challenging. Therefore will continue to see positive absorption.

No question commercial real estate transaction activity is slow. Interest rate volatility and construction cost inflation making it challenging. Have to build margin of safety when underwriting debt. Results in wide bid ask spreads.

Lot’s of inspiring downtown community development projects in the works. The ICE District, the home of the Edmonton Oilers, which completed in 2016, is among the top arena districts in the world and an epic scene on Game nights - go Oilers!

Edmonton council and developers are working to build a lot more great community projects which will bring greater numbers of people to the core to live, work and play.

To sum up, a lot of positives for the Province and particularly Edmonton and it will be exciting to see how things play out.

1 Quote

“Be yourself; everyone else is already taken”

Oscar Wilde

A Question

Poll: how many of you invest in the stock market? Please respond with Y or N

_____________

Thank you,

Eddie Gudewill, CFA

How did you like today's Journal?

🎓 Want a smarter, simpler path to long-term wealth?

My self-guided ETF investing course walks you through the exact strategies I use and teach in this Journal—built for real people with real lives.