Hola amigos.

Had a nice catch up with my former boss and Portfolio Manager at Richardson Wealth, Tyler Steele.

He passed along an interesting discussion on Mortgage and Term insurance which forms part one today.

Keep in touch with people and learn new things!

If you are enjoying the Journal, please forward to your friends to subscribe.

Personal Finance

Today we talk about Mortgage insurance vs Term insurance.

Don’t get the former, get the latter. You can stop reading now if you want.

When you get a mortgage, the lender will typically offer you insurance for that mortgage in case you die.

This can be useful because if you’re dead and your spouse doesn’t have any income to pay the mortgage next month, they could default on the loan and lose the house.

Unlikely as it might seem, therefore, having an insurance program in case you die early is a good idea.

But did you know that mortgage insurance is ghastly expensive and not a very flexible product? Instead, the best choice is basic term insurance.

Scenario:

Applicants: Male (age 52) and female (age 46), both non-smokers.

Coverage: $700,000 joint first-to-die policy.

Term: 10-year (matching expected mortgage payoff timeline).

Annual Premium – Personal Life Insurance: $1,635.

Annual Premium – Lender’s Mortgage Insurance: $7,740.

That’s a $6,000 difference in annual premium!

Furthermore:

Mortgage insurance ONLY pays off the mortgage, can’t be applied to anything else.

Term life insurance covers your mortgage AND any other financial costs, like other debts, replace income, funeral expenses, etc.

If you’re healthy, Term life insurance offers great discounts on your premium payment. Unlike the mortgage insurance, which gives no such discount.

Mortgage insurance coverage is void if you default on your mortgage. On the other hand, Term insurance coverage is not impacted if you didn’t pay last months mortgage (so long as you pay the insurance premiums of course).

There are other interesting comparisons, you can download this PDF to learn more.

So, in advance, “no thank you, Mr. Lender, I will not be taking any mortgage insurance from you when I get a mortgage.”

Instead, I’ll go for the 10 year term personal life insurance, save a bunch of money, and have a lot more flexibility.

Makes me wonder how the mortgage insurance option even exists when it’s easily dominated by traditional Term?

Such odd things still exist in this world.

Like having to ask the bank teller ‘permission’ if I can send a wire transfer.

💝 Newsletter subscribers get 10% off the Simply Investing course with the code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

If and when Warren Buffet dies, there may be a buying opportunity of a lifetime to get Berkshire Hathaway shares.

Maybe.

Since it’s already so anticipated, everyone and their dog has been saying they’ll buy up the discounted shares, that the effect will probably be pretty muted anyways or at least very short term in nature.

His successor, Greg Abel, can’t be as prolific as his predecessor, but he’ll probably do a pretty good job. And the behemoth that is Berkshire, which is essentially a massive investment holding conglomerate of companies, will operate as usual and value to the Berkshire stock will adjust to reflect reality.

Regardless, if there is ever a chance to add to Berkshire on a massive discount once he leaves us, may be buying opportunity.

I often get this question, Eddie should I buy the S&P500 or Berkshire or both?

My answer is usually, if you’ve discovered Berkshire and Buffet and want to allocate—feel free. Hard to go wrong no matter what your perspective is.

Probably best to have a good chunk in the S&P500 (as per usual) and add a little dose of BRK to the mix if you please.

It’s already a top 10 holding of the S&P500 so all of you folks already own it, you’d just be doubling down your exposure.

Truth is, Berkshire is so massive, it is essentially a reflection of Corporate America anyway.

And in fact, if you examine the performance of this wonderful story, you see it was through the early years when it generated MASSIVE outperformance vs the rest of the market.

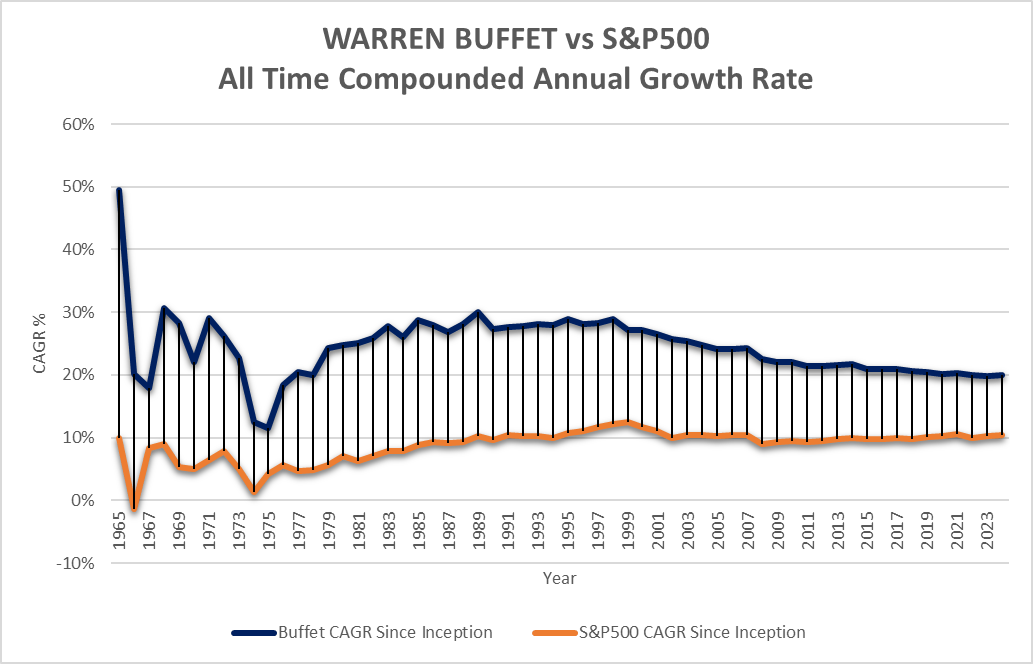

Here is a chart of Berkshire’s rolling compounded annual return since inception.

Since 1964, Berkshire has compounded at 19.9%, vs the S&P500 at 10.4%.

$10,000 in Berkshire is now worth $550,000,000.

$10,000 in S&P500 is now worth $3,850,000.

But that’s only if you were lucky enough to get in at the VERY beginning of Berkshire’s stock.

You see, if you look at the rolling 10 year compounded return comparison, you can see it is basically bang on the S&P500.

So while many of us, including yours truly, will quote Buffet’s 20% annualized return and his investing prowess, much of that was cooked up in past.

The question is, based on what we know now: that Berkshire is so large, it essentially is Corporate America, evidence of the last 15-20 years performance converging basically exactly to the S&P500, does anyone really expect buying $10,000 today of Berkshire vs $10,000 of S&P500 will diverge much in future performance?

That’s the million dollar — or billion dollar question — if you have 65 years of investing ahead of you.

I think they’ll be pretty close.

Doesn’t mean I won’t be waiting to buy the dip if/when Warren joins Charlie.

Real Estate

Interesting signal in the Office sector.

Oxford is the real estate arm of the Ontario OMERS Pension, it’s massive, with about $81 Billion in real estate investments globally.

For the past decade Oxford has been a net seller of Office and COVID certainly threw a massive damper on the sector as work from home turned once buzzing office buildings (and downtown cores) 40-50% vacant, valuations plummeting, equity being wiped out in certain cases as bankruptcy/recapitalizations become more common.

We have essentially lost an entire asset class to invest in.

But when you have a highly experienced investor with deep pockets make a big splash like buying up a handful of office buildings in both Vancouver and Calgary, it’s definitely a signal to note.

“Oxford notes its rationale for the acquisition stems from its belief in a bifurcation of the office sector in the wake of the COVID pandemic and work-from-home trends, which had deeply cut into confidence in the sector as occupiers tried to rationalize future space requirements.

It notes an ongoing flight to quality from many top-tier employers, with the best properties in key hubs such as Calgary, Toronto and Vancouver significantly outperforming the market with over 95 per cent committed occupancy.

Recent office market data has also showed a potential upswing in the sector in major markets, with improved leasing activity over the past couple of quarters.”

Of course, not all office is built the same. Oxford sees strength in the AAA, amenity rich, well located product.

They are not betting on the C and B Class buildings or the suburban office parks…yet.

Time will tell how this bet plays out, but worth watching.

1 Quote

“There are two lasting gifts we can give our children: one is roots, the other is wings”

Hamish Simpson

GNS Headmaster 1960-1982

B. 1936, D. 2025.

(quote formally attributed to Hodding Carter)

A Question

Mortgage folks—do you have Mortgage Insurance with your Lender? Or Term Insurance?

_____________

Thank you,

Eddie Gudewill, CFA

How did you like today's Journal?

🎓 Want a smarter, simpler path to long-term wealth?

My self-guided ETF investing course walks you through the exact strategies I use and teach in this Journal—built for real people with real lives.