Hey folks hope everyone is having a great week. Took the little girlies for the first time ever on my Dad’s boat, the Sprite V (originally my Grandad’s boat - he called it Sprite because of his Coca Cola business, Sprite being a feature product), for a day trip in the Gulf Islands. We had a blast, did some hiking, swimming, and relaxing. The girls put on a pretty good show except they don’t yet understand that one must not eat greasy foods on the back deck lest the teak wood get stained!

If you are enjoying the Journal, please forward to your friends to subscribe.

Personal Finance

There are three (3) factors that determine financial success or failure:

1. Income - your responsibility

2. Spending (saving) - your responsibility

3. Returns - Portfolio Manager responsibility (you, if you Do-it-Yourself, or your Advisor)

Two beats one usually.

And if you buy the market consistently, you reduce impact of (3) failing you.

My friends know I talk a lot about diversified low cost ETF investing as a great way to invest – it is!

But, it’s not the only way to skin the cat.

You may have more experience investing in other asset classes – all the power to you.

But if you are:

- just a regular human being

- workin’ hard and focusing on your family

You can start investing better with a hands off approach by using broad based ETFs.

End of the day:

→ Be a Lion

→ Don't be a Gazelle (well, at least not all the time 🤣)

💝 Newsletter subscribers get 10% off the Simply Investing course with the code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

Stock market on a whipsaw since the Israel / Iran conflict flared up last week.

That, plus ongoing geopolitical risks elsewhere in the world, stubborn inflation, US central banks keeping interest rates steady, residential real estate turmoil, excessive debt levels at both the government and private level, risks of AI on the job market, the list goes on and on.

Do you know what else goes on and on?

Capitalism.

There will be always be short term periods where things seem dicey. But through good times and bad, capitalism always pulls through on the up.

Hopefully, you are investing in it.

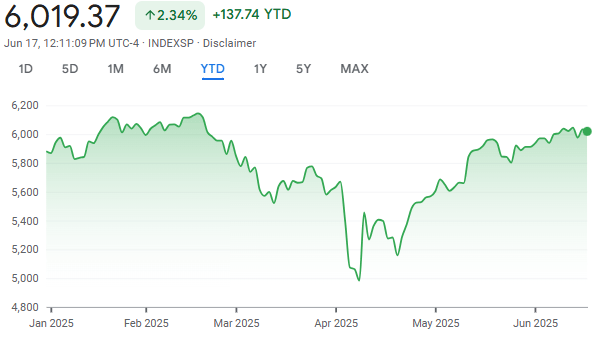

A few charts below to remind you: when in doubt, zoom out.

SP500 Performance, Past 5 days

SP500 Performance, Year to Date

SP500 Performance, Past 5 Years

SP500 Performance, Past 30 Years

Real Estate

Good podcast on the 345 year Grosvenor real estate empire.

Main point of the podcast is about investing in a real estate with a generational perspective: patience, time, compound interest, and never selling (avoiding capital gain taxes).

While I’m normally interested in value add investment properties, i.e. find an existing property with existing income, fixing it up or improve the cash flow in some form or another, therefore increase value, and sell it at a profit once the business plan is complete, there is an interesting case to be made for holding real estate on a permanent basis.

You compound your equity without constantly triggering capital gains taxes.

You also avoid transaction costs, reinvestment risk, and the stress of trying to time the market.

Instead, the return compounds quietly in the background, driven by rental income growth, mortgage paydown, and long-term appreciation.

Sometimes, the best trade is no trade at all. Especially if you can be patient.

And while I will always consider the value add, rinse and repeat business model a core component of my portfolio now and in the future, I am definitely interested in acquiring and holding long term real estate too.

Thanks for sharing the podcast, Sam.

1 Quote

“Laid back

With my mind on my money and my money on my mind

Rollin' down the street, smokin' indo

Sippin' on gin and juice

Laid back”

Snoop Dogg

A Question

If you could give your younger self one piece of advice, what would it be?

Looking forward to the responses here.

_____________

Thank you,

Eddie Gudewill, CFA

How did you like today's Journal?

🎓 Want a smarter, simpler path to long-term wealth?

My self-guided ETF investing course walks you through the exact strategies I use and teach in this Journal—built for real people with real lives.