What’s up you Lions.

Thanks to those responding to the poll about email service providers. Apparently Outlook recipients get wonky versions of this letter or sometimes the links/images don’t come through—sorry about that—sadly not much I can do about it. Thankfully only about 20% of you are using Outlook.

Onto business...I made The Ultimate Rent vs Buy Calculator for you in the Real Estate Section and due to it’s length, I’m skipping the Personal Finance and Stock Market sections today. Just read a past issue if you’re yearning for it…much of this stuff never changes anyway: earn more, spend less, invest the diff.

If you are enjoying the Journal, please forward to your friends to subscribe.

Real Estate

Following last weeks discussion on Buying a $4.5 million home or Renting the same for $102,000, I had one reader reply with some caution.

This guy is smarter, more experienced, and far richer than I’ll ever be, so I always listen and learn.

He had some good comments:

Sorry, can’t get this out of my mind. You also have to consider rent increasing over time, so your $4.5M would have to grow – after tax – sufficient to cover the rent increase through capital appreciation or re-invested yield, either way you’re going to need a pretty hefty return to cover all that. But the proper way to look at this is to assume you have a mortgage. To duplicate that on the investment side you would have to use leverage and wouldn’t get the same terms and rate, therefore much more risky. This also ignores the pride of ownership and control of destiny, because as a tenant you are ultimately at the mercy of the landlord. Actually, the rent is after tax, so that’s a 4-5% return before tax. 4.5M x 5% = $225K x 0.5 = $112.5 after tax/12 months = $9,375/month approx. depending on tax rate and what the house actually sells for. You could be a bit further ahead investing and paying rent, but then what’s your $4.5M worth in 44 years vs. a house? Also, if your investment appreciates, the gain is taxable versus the house which isn’t, if it’s principal residence. It would be interesting to track GRM over time in a specific market like Victoria. I bet it doesn’t change that much. Using your logic, no one would ever buy.

Kaboom! Shots fired.

My Response:

I think markets like Victoria and Vancouver and Miami and New York etc will always be elevated. I've tried searching for a historical GRM averages but no luck yet... Fair point grossing up the yield and using a mortgage.

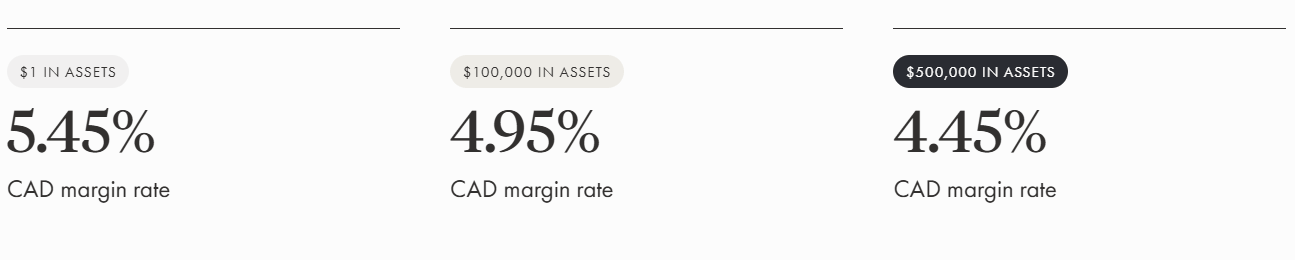

You could say a fair mortgage of 70-75% LTV at 4.5% for the house. But also need to be fair and allow for 50% margin on your portfolio at prime (actually Wealthsimple offers me margin at Prime -0.5% and up to 70% against the XSP SP500 ETF).

Calculations are numerous, accounting for maintenance, insurance, landscaping a 1 acre property, property taxes, and tax free compounding, although you can't spend your house (unless you keep borrowing against it) and it's highly questionable that residential real estate will "go up" as it did over the last 25 years. Probably fair to assume 3% CAGR . For renting and S&P500, I like saying 10% but let's be fair and say 8%. Then you have rent increases (and rent controls) and utilities and insurance etc to also consider, no forced savings (principal payments), whether you margin the full 70% or stick with 50%, no tax free growth (just tax deferred growth), and no real control of your destiny.

I will try and do up a spreadsheet eventually to compare, when I find some real time... Anyway, truly a lot to consider and everyone may lean on qualitative components differently. All that said, this unique example at 44x is crazy. 44 years at 3% and 4.5 million turns into $16,000,000 if you buy. 44 years at 8% and 4.5 million turns into $46,000,000 if you invest.

I don't care what differences in tax free growth or pride of ownership mean qualitatively.

The difference is too high not to agree that 44x is insane.

ANYWAYS, I too couldn’t get this out of my head, so yours truly DID find the time to do up a spreadsheet…

I’m actually pretty proud of this one…it handles this Rent vs Buy calculation much more precisely than any others I’ve ever found on the interweb.

If you are buying, it factors in inflation, home price growth, down payment, mortgage details, property tax, insurance, utilities, maintenance, even landscaping (especially if you’re buying a 1 acre property).

If you are renting, it factors in rent, inflation, insurance, utilities, and other costs.

But the real interesting bits come when you also consider your gross income, net-after-tax income, the difference between your net income and cost to own, the difference between net income and cost to rent, investing the savings between ownership and renting in the stock market, investing the down payment in the stock market, borrowing against your investment portfolio (it’s called margin debt) to enhance your returns, getting a mortgage to buy the house but also borrowing against your home equity using a HELOC after each year of principal payments, because if we’re really trying to be financially detailed, we must leverage what we can and when you build equity either in an investment portfolio or a home, you can in fact borrow against it to invest (we do this in our commercial real estate deals for example through up front mortgages at purchase or refinancing it with more debt during our ownership period to take more cash out).

Notice I said the word financially detailed, not emotionally detailed—because when you are using DEBT, especially in the stock market, emotions run high and if you make an emotional mistake you can get wiped out.

Be that as it may, calculating rent vs buy from a numbers stand point should start on an equal numbers footing.

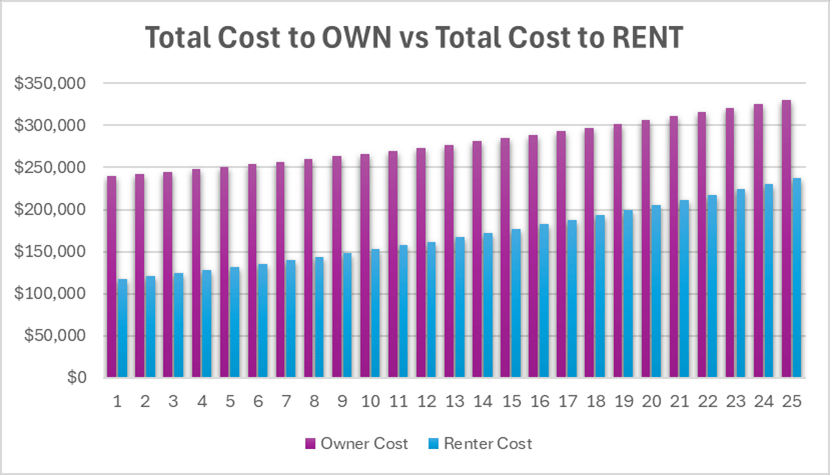

In the example of Buying a $4.5 Million Home or Renting the Same for $102,000, I calculate the annual cost to own vs rent here:

Stark difference. Ownership costs almost $120,000 more than renting.

And here is the difference in Net Worth over 25 years:

Summarized in Table format:

Pretty sure the 44x GRM warning flag worked on this example. Renting, here, is far better than owning (financially speaking 😄).

You can download the spreadsheet to view the assumptions and test out some scenarios for yourself. Use the inputs page for all of your assumptions, then click through the rest of the tabs to see how the results look, especially looking at the tab labeled “Invest” to see how the trend in net worth under each scenario plays out.

While this one example doesn’t scream - buy, buy, buy! - that doesn’t mean you should never buy. For many of us, buying a home will be the single biggest investment of our lifetimes, with the added discipline of forced savings through principal pay down and tax free gain for principal residence (in Canada) that qualitatively may be more valuable than any spreadsheet.

Finally, if enough people would like to do a Zoom to review this spreadsheet in detail, how it might apply to you, or discuss when it does make sense to buy even if the numbers say otherwise, happy to set up a group conference. Let me know!

1 Quote

“There are three ways to ultimate success: The first way is to be kind. The second way is to be kind. The third way is to be kind.”

Mr. Rogers

A Question

Who is interested in a group zoom call?

How did you like today's Journal?

🎓 Want a smarter, simpler path to long-term wealth?

My self-guided ETF investing course walks you through the exact strategies I use and teach in this Journal—built for real people with real lives.