Hey friends,

Finished Red Roulette, a story of politics, communism, rampant corruption and capitalism by permission. Worthy of a read.

Just started reading Freezer Order, the follow up to the prolific Red Notice by Bill Browder and his fight against Russia. Mj read this one. She thought she wouldn’t like it. Turns out she loved it. You don’t have to ‘be in finance’ to like Bill’s work.

Next I’m going to read From Third World to First - A Singapore Story, a recommendation from a friend about the story of a nation that went from humble beginnings to world-stage under a technocratic ruler: Lee Kuan Yew.

Onto business….

Time value of money calculator everyone can (should) use.

Stocks and Bitcoin are in turmoil.

More on the developing story about the BC-Aboriginal Title Claims

Personal Finance

If you have $100,000 today, and you invest $25,000 for the next 15 years, and you earn 10%, how much will you have at the end? What about in 25 years?

Have you ever wondered how we calculate these results?

It’s actually really simple, because there’s an easy calculator you can use.

Go here: future value calculator

Type in:

Number of periods: 15

Starting amount (your present value): $100,000

Interest rate (10% is market; 20% is buffet; 4% is a bond): 10%

Periodic deposit (how much you contribute to the portfolio each year): $25,000

Calculate: $1,212,036.86

Pretty cool right?

It’s a shame only “finance folks” get taught how to use one of these. Even then, I’m not sure many finance people are using these calculators as they move through life.

Highly recommend playing around with it. You can pretty quickly figure out how much you could have in retirement with a few simple inputs.

Also, for some more fun, the calculator has a couple other "modes” you can use as well.

Instead of the previous example, you could say:

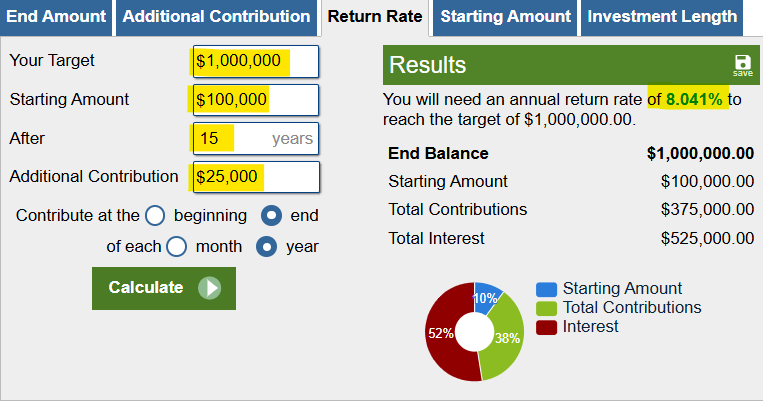

“I have $100,000 today, 15 years to retirement, $25,000 annual contributions, what interest rate will I need in order to reach $1,000,000?”

Here is the answer:

It tells you that you must earn approximately 8% compounded in order to reach that million dollar goal.

And one more just for fun:

“I actually want $2,000,000 in 15 years, starting today with $100,000, earning 10% compounded, how much do I need to contribute each year to reach the $2 milly?”

Here you go:

In my line of work I use the Time Value of Money calculators ALL THE TIME.

It’s so dang useful for evaluating investments, my newsletter writings, quick conversations I’m having, but most importantly understanding my own personal situation vs where I want to be in the future and how to get there.

Just remember the inputs in general:

More time, higher results

More contributions, higher results

Higher returns, higher results

Higher present value, higher future value

Pull the levers that you can control the most. Returns are a major factor, but most people screw this up by market timing and gambling. Focus on upping your contributions and spending more time in the market, earn the market return, and you’ll wind up with a big fat portfolio you won’t even know how to spend—good problem to have!

Most people dream of investing, then they wake up.

My ETF investing course takes you from dream to reality—you’ll learn how to invest confidently without chasing headlines.

👉 Save 10% with code SIMPLYINVEST →

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

A quick scan of google finance this week and the stock market is apparently in turmoil… with the SP500 down 2% in one week. OMG.

Meanwhile the SP500 is up 15% year to date, it was up 25% in 2024, and up 26% in 2023. String those numbers together and stocks are up 1.8x.

Despite the fact that the SP500 has had multiple corrections of 5%, a few 10% declines, and the tariff tantrum of almost 20% earlier this year during this time period, I have been shouting from the rooftops about the benefits of the SP500 for longer than this newsletter has been around—hopefully some of you listened, ignored the noise and have stuck to your investing parameters.

This must be the most hated bull market I’ve ever participated in. People seem to crave bad news, they feed off it, it’s human instinct I guess. They see a 2% pullback in stocks and a 20% decline in Bitcoin and assume the world is ending.

But you know what?

Volatility is a feature, not a bug.

Nothing is free in life, nothing goes straight up and to the right. If it does, it’s a major question mark—Bernie Madoff comes to mind—all the private real estate funds gating their investors also comes to mind.

In order to have grown your money by 1.8x via the SP500—or 6x via Bitcoin—you had to sit through multiple painful periods. Bitcoin has had countless corrections more than 10% and many as much as 20% to reach 6x higher.

If you listened to every headline or AI summary of the markets and volatility and what Jerome Powell’s latest comments around inflation mean for short term market movements, you’d have sat this entire rally on the sidelines. That’s the kind of emotional investing stance that will keep you poor - sorry, but it’s true.

Will the stock market ant Bitcoin enter a prolonged downturn? Maybe…but who knows when? Today? Tomorrow? 3 years from now and its many multiples higher than today?

Broken clocks are right twice a day.

So don’t succumb to the pessimists (more on them in another journal).

Optimists do much better.

Real Estate

Continuing on the developing story about the BC-Aboriginal Title Claims

From Wes Mussio, lawyer:

“Knowing that the NDP and David Eby are gaslighting the public about their intentions to protect private land ownership in B.C. over aboriginal title claims, I personally came up with the idea of passing the property rights protection act, which would have insured that private ownership of land in British Columbia takes priority over aboriginal claims. As expected, the NDP not only voted the legislation down, but they refused to let the legislation go through first reading, a Parliamentary norm, so it could be debated. In other words, the NDP had to show its cards, and those cards are that they have every intention to enable the taking of vast amounts of private property to give to aboriginal claim seekers.

The main reason for introducing this legislation was to prove clearly that the NDP has no real intentions to defend private ownership and is quite happy to have aboriginal claims result in seizure of vast amounts of private property from non-aboriginals. Where is the legislation from the NDP that supports landowners? Given this urgent matter that will destroy British Columbia, why is the NDP not doing anything? Obviously, because they’re quite happy with the taking of private land.

So next time you have an opportunity to vote, if you’re a landowner, you need to get rid of the NDP before you lose your private property and, in many cases, your life savings.

Interestingly, the mainstream media is not even reporting on the NDP striking down this legislation and the legislation eliminating the land claim acknowledgement, the one you see on government emails and hear at government meetings at all levels stating we are on stolen land. The reason, of course, is that no right-thinking individual that owns or wants to own property would ever support the NDP again because the NDP literally want to take your private property and give it away for free. So next time you hear the NDP or David Eby say the NDP is protecting private landownership they are clearly lying to you.

I guess this is good news for anyone that is a hater of Canada and colonialization. The “land back” initiative of the radical left is in full swing.”

For more: B.C. NDP blocks bill to protect private property rights — within days of promising to defend them

1 Quote

“Give an inch and they’ll take a mile”

—unsure but true dat

A Question

Any specific topics you’d like to see explored in the Journal?