We have a great community of contributors and the shared stories, strategies, and healthy debate are valuable learning opportunities for many.

Today I include an entry from a fellow reader in the Personal Finance section.

And a rare punch at Wealthsimple.

PS. My baby girl Julia turned two today - feliz cumpleaños mi curi 🥹

Personal Finance

“Making yourself consistently feel poor is a good way to get rich. I’ve always run my life with a very tight treasury, i.e., keeping very little cash in my bank account because it makes me want to spend it when it’s there. So especially when I was younger I would only keep like five grand in my bank account at any given time and the rest of it is in interest-bearing accounts or investments or paying down my line of credit.

Just optically, not having the larger digits in your account even if you’ve earned that money is a nice way to not spend it.

Second is that I think there is an over-importance put on gross salary versus tax efficiency. I don’t think anyone taught me through business school that running a consultancy under a small business you pay 12.5% tax rates up to $500,000 grand of annual income.

Like somehow being an investment banker making $150,000 grand a year but paying 43% tax rates was the holy grail coming out of school, whereas being a small business owner paying 12% tax rates and dividend-ing yourself only what you need while keeping the rest in a holding company is way better long-term. Always defer taxes as long as possible and own assets in your company. Like I own my boat and my 911 in my personal real estate corp, fully above board.

Last thought is that one of the main reasons I’ve gotten wealthier than my peers is that I never let my spending habits increase at the same rate as my income, and it is way easier when you are younger to live like a poor student even when you’re making a good income. And lifestyle creep is real and it’s difficult to go backwards. So one needs to try and continue living like a poor person even when they’re making a pretty good income because the delta is what you can invest early and have it compound.”

Well said, Roy.

Build wealth the way I actually do it 🧠

My ETF investing course teaches you the easiest, low-cost way to be a great investor and build a large portfolio. You’ll learn how to invest confidently without chasing headlines or picking stocks.

👉 Save 10% with code SIMPLYINVEST →

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

Wealthsimple is doing a lot of advertising around margin accounts.

That Wealthsimple is expanding its business is commendable, and competitively speaking, a likely necessity, but my distaste for the colourful marketing messages on these features that make risk sound ‘easy’ is palpable. I still love the platform, and recommend anyone without an account to open one (takes 5 minutes), but I’m going to pick on them a bit here.

If you have to ask what margin is, or how options work, you shouldn’t engage in either.

But in the interest of spreading awareness, here’s a primer on margin trading.

You borrow money from the broker (Wealthsimple) to buy more shares than you can afford. Your portfolio is the security and interest payments run about 4-8% depending on your account size your creditworthiness.

The appeal is higher returns.

Example: you want $20,000 of Apple stock but only have $10,000. Wealthsimple lends you $10,000.

If Apple doubles, the math looks like this:

Sell for $40,000

Repay $10,000 loan

Less $10,000 original investment

Profit = $20,000

Voila, your equity went up 200% even though the stock only went up 100%.

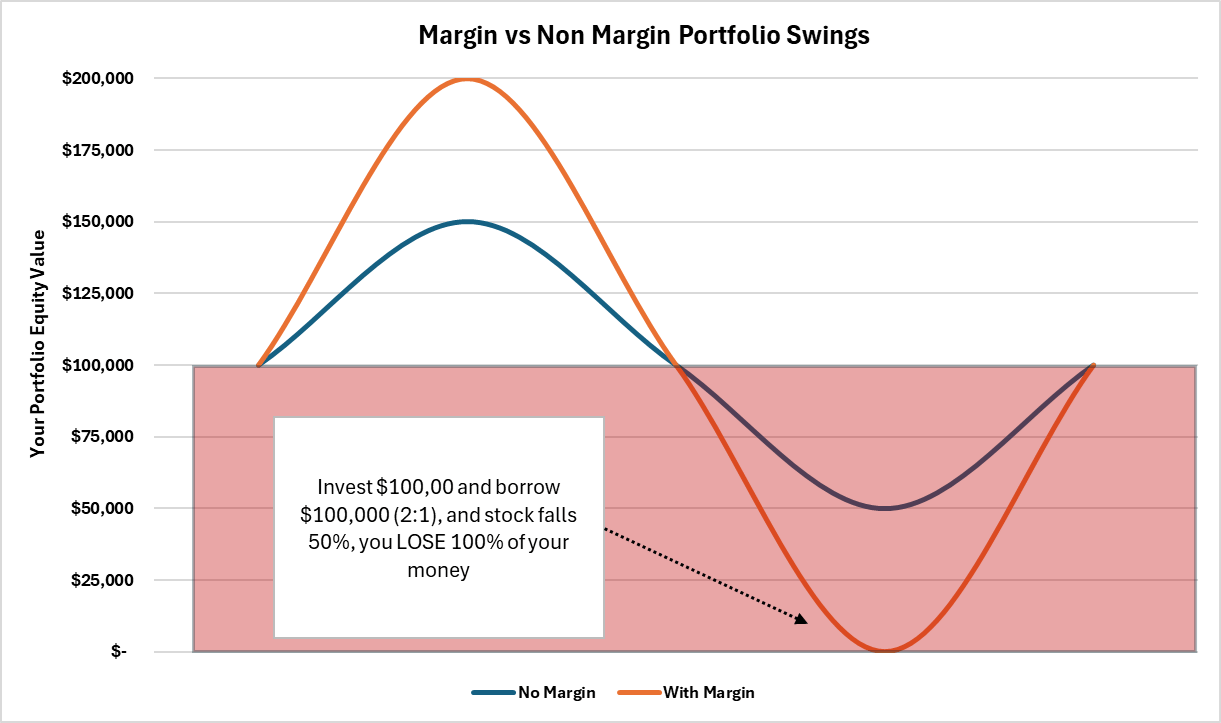

That’s leverage. But what happens if it goes down 50% or more (like in 2001, 2008)?

If Apple drops 50%, this is what happens:

$20,000 goes to $10,000.

Since the stock is now lower than it’s required margin ratio, Wealthsimple calls, “hey, we need you to put more cash in the account today or we will be forced to liquidate your portfolio.”

If you don’t come up with the cash, they SELL the remaining stock for $10,000 to pay off the loan, and you lose your $10,000 with no chance to ride any potential rebound higher.

Equity gone, in one day.

So, while get rich quick is enticing, using margin to “enhance” returns in the stock market is usually a very bad idea because the stock market is so volatile whereby you can lose everything and even owe more if there’s a big market downturn or even a single stock seismic event.

Mildly leveraged investments are o.k. (20% max) but really should only be considered by very few people, if that.

Again, while I understand why Wealthsimple is rolling out these features, I highly recommend that readers keep it simple and invest only what you can afford to lose and with a long term time horizon.

Tried to represent the risk visually below.

Is the upside potential worth the downside potential?

1 Quote

“Your newsletter is the best one I'm subscribed to. Thanks again for this letter.”

Thank you and my pleasure, Cesar.

A Question

Thoughts on the margin investing peice?