Hello everyone!

If you're enjoying the Journal, help it grow.

Forward this to a friend who'd appreciate honest takes on money.

If they subscribe using your link, you’ll get rewarded (details below).

It’s a small way to support the work—and it really helps.

This Journal grows 100% through word-of-mouth—no ads, no fluff.

If it’s helped you, pass it on.

Personal Finance

Been doing some financial planning/consulting work with clients lately.

It’s interesting because while numbers and financial theory are generally set in stone, everyone’s situation is always different, calling for a different strategy.

And maybe most important is their emotional relationship with money and lifestyle.

Factors like upbringing—did they grow up rich, or did they grow up poor and earn their own money—make a huge difference in a person’s financial perspective.

Growing up wealthy can create a sense of empowerment, but it can also lead to entitlement—thinking money grows on trees. That mindset is parasitic, and can lead to reckless spending and poor decisions that erode wealth over time.

I’m not impressed with anyone who lives a lavish lifestyle. Wealth isn’t about what you spend. It’s about freedom of choice. Money helps with those choices. But left unchecked, that money can be easily destroyed. Choices, gone.

You don’t want to get to 67 years old, previously of substantial family wealth but today no money, with only a handful of choices on your plate, including the least preferred, but likely the best option: looking for a job.

On the other hand, growing up without money can build discipline and an appreciation for a dollar.

This is why financial planning isn’t just numbers. It’s mindset, habits, and long-term thinking. Some people need to rein in their spending, others need to stop hoarding and enjoy what they’ve built.

At the end of the day, money is just a tool.

Like a chainsaw, wield it recklessly, you might lose an arm and a leg.

Wield it properly, and you can create something beautiful.

Final advice: earn more, spend less than you earn, don’t be a bonehead, invest early and often, don’t put all your eggs in one basket, and enjoy.

💝 Newsletter subscribers get 10% off the Simply Investing course with the code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

5 Charts every long term investor should keep in mind:

Why you must invest

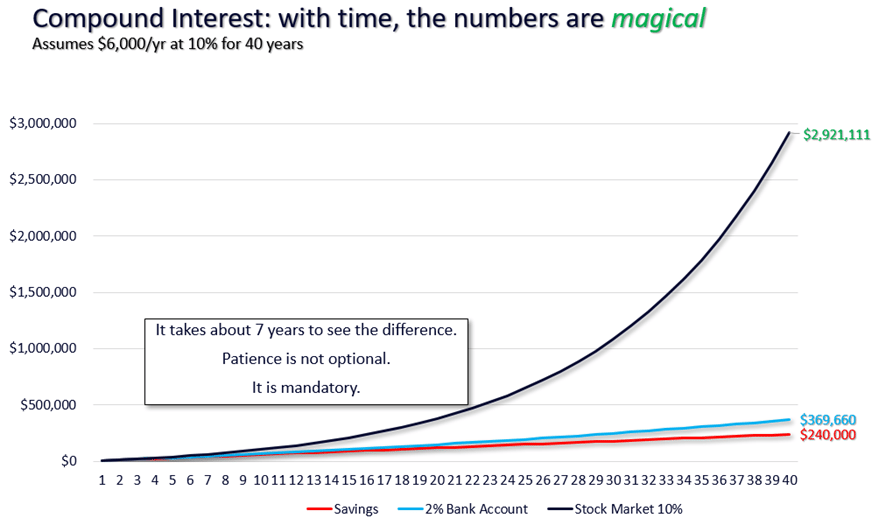

Compound Interest is Magic, requires time, don’t waste it

Stock declines are a feature, not a bug. Get used to it.

Capitalism is amazing. Be wary of those who say otherwise.

Investing is not Gambling. Stocks go up more than they go down.

Real Estate

Not enough time this week for any value add comments.

Instead, here is my trusty quick and dirty Real Estate return calculator for download.

Good for understanding potentials on a high level with easily changeable inputs to see how different variables (like leverage, profit splits) affect your projected return.

Let me know if any questions!

1 Quote

It should never be forgotten that socialism is always and everywhere an impoverishing phenomenon that has failed in all countries where it's been tried out. It's been a failure economically, socially, culturally and it also murdered over 100 million human beings.

A Question

Who here is tired of the news?

_____________

If you enjoyed this issue, please forward this email to your friends to subscribe.

Thank you

Eddie Gudewill, CFA

How did you like today's Journal?

Investing Course

If you want to learn everything you need to know to be a great investor, consider my self guided ETF investing course.

Customer review:

"Hey Eddie - your course is precisely what I have been missing and has been so helpful in giving me more confidence to invest myself" - 30 year old MBA student.

What you get

✓ 2 hours video content

✓ Take at your own pace

✓ Training by a real portfolio manager

✓ Excel templates i.e. budget, retirement calculator, rebalancing spreadsheet, and more

✓ Unlimited lifetime access, and all future updates at no cost

✓ 100% money back guarantee. If you don't like it, let me know and I'll give you your money back.

I'm trying to make you a millionaire - not sell you some junk.

You will transform from being unclear and apprehensive, to a capable and confident investor.