Hello everyone!

Been a while since I went on a rant.

Hope you enjoy section one and would really love your feedback.

Personal Finance

There is a major problem with our society: only 48% of Canadian adults invest.

Excuse my Spanish, but coño la madre!

This is just crazy to me. The question is, why?

The common excuse: it’s too complex.

Dinner table talk from a generation of boomers that encouraged Millennials and Gen Z to just work hard and save.

But, as readers of the Journal understand, that is only half the battle.

If you only work and save, you will lose the war.

You MUST invest. That is how to win the war against financial hardship, growing inequality, etc.

And complexity? Yes, indeed, Wall Street designs it this way:

Yield Curve, Alpha and Beta, P/E Ratio, Dividend Yield, Iron Condor, Gondor, Westeros, Naked Puts, Butterfly Spread, Straddle, Synthetic Call, Delta Hedging, Gamma Scalp, EMA Moving Average, Asset Allocation, Liquidity Ratio, Internal Rate of Return, TFSA, RRSP, ETF, REIT, Margin…

Honestly there are thousands of terms and the more complex it sounds the more they make in fees off of you.

But for the Great Investor, it’s actually quite simple. To use an analogy:

I don’t know how the heck a car works. Or where the parts come from.

But I love to drive and it takes me from (a) → (b).

Same thing with investing. Stop trying to figure out what’s under the hood.

Just learn how to open an account → deposit money → search XSP → click buy.

Seriously, we all know how to pay bills online, but we don’t ask how the website code functions. We just do it.

We are all educated. And if you’re not, you can be - we all have internet - google it!

But contributing to an investing account? Absolutely not!

Anyway, last week I had a great catch up lunch with an old friend from my home town.

We had a great discussion about investing. But something really stuck with me, he said:

“Eddie, one thing I’m mad about, mad at my parents about, is they never taught me the importance of investing. Only to work hard and save.”

Obviously many folks have plenty of experience investing, but the deeper I investigate the more I am realizing that the comment above is actually quite prolific.

And that is sad.

And by the way, it’s not just the parents fault.

Schools certainly don’t teach it. Society expects the young adult to figure it out. Or maybe Society relies on them not figuring it out so they can maintain the status quo of the have’s and the have not’s. Who knows.

Hell, for all the CFA studying, equity research and portfolio management I’ve done, none of it EVER discussed the importance of our own personal financial management.

Regardless, imagine if we started investing straight out of high school (EVERYONE should), I believe society would be far better off and we wouldn’t have people screaming at each other.

Good thing is, I truly believe we are trending in the right direction.

Seeing people sign up and complete my investing course in 2 hours and then sending a message like this…

Simply investing masterclass feedback!

I recently took your Simply Investing Masterclass. It was incredible! Thank you for the thoughtful time and effort that went into creating the modules. You explained things incredibly clearly and helped me build confidence as I start my DIY investing journey! It’s exactly what I needed.

Feedback: The whole course was great, but the most valuable part of the course for me were the pie charts of individualized portfolios depending on stage of your life/risk aversion. I was going to just buy stocks, but now you have me considering bonds too. Your graph of ETFs to buy is also incredibly helpful and I’ll be using it a lot, so thank you for that.

…tells me the future is bright among the parting dark clouds.

To conclude, since we have subscribers here that are 18 years old all the way to highly successful and very wealthy investors in their 70s, I present you with some questions:

Parents - what was your approach to teaching your kids about investing? Did it resonate with your kids? What did your parents teach you about it? If you could change anything, what would you have done differently?

Young(er) people - did your parents teach you the difference between saving and investing? If you are a new parent or want to have kids one day, how will you approach this problem with your children?

💝 Get 10% off the Simply Investing course for limited time only, code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

NVIDIA is now the most valuable public company in the world.

I’ve heard some stories of people piling in with their entire retirement portfolio.

Because now that it’s the Top Dog, why wouldn’t it be the best investment going forward?

Well, I leave you with the image below and hopefully you infer the right conclusion.

Spoiler - buying NVIDA today with all of your retirement money is quite literally the worst advisable investing strategy I’ve ever heard of.

Don’t be that guy (or gal).

Based on market cap.

Real Estate

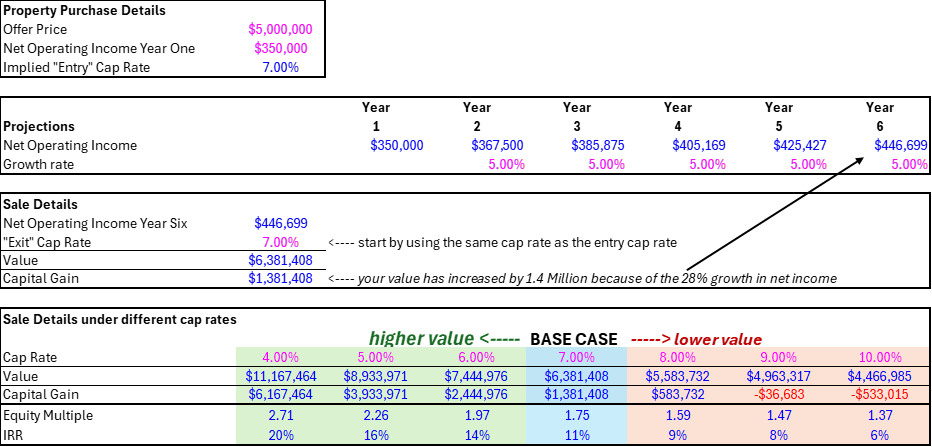

Last week we learned why the Real Estate Cap Rate is important, and also how to calculate a property valuation today:

Income ÷ Cap Rate = Property Value

More importantly, however, is the future cap rate you assume on sale because of its significant impact on valuation.

All else equal:

Cap Rate DOWN = Property Value UP

Cap Rate UP = Property Value DOWN

So if you see a wonderful real estate investment opportunity and the sponsor has lowered the "Exit" Cap Rate which increases the sale value, you should question WHY they have made that assumption.

Simply saying “we expect cap rates to decline because we believe interest rates are declining”, is not a good enough answer.

If, however, a sponsor is implementing a substantial capital upgrade, a repositioning project, or replacing mom and pop tenants with national retailers, these could be reasons that are somewhat defensible to lower the exit cap rate.

Taking a “C Class” building to an “A Class” will warrant a higher value for the same dollar of income. Or buying a large portfolio of properties from an institution and turning them around to sell individual buildings to the local doctor that wants to own a KFC - they always overpay.

Just like in the stock market - it’s no good to buy Microsoft and pretend it’s Price/Earnings multiple is simply going to increase in 5 years. That’s worse than predicting short term stock market movements.

No, instead, understand the business and the actual levers management can pull to increase the income. If income increases, and you assume the same P/E multiple, the stock will be higher.

Same thing with real estate.

A lot of sponsors will fudge future numbers to make an investment look good and draw unsuspecting investors wearing rose coloured glasses into a crap deal.

So it's up to you, the investor, to take a closer look.

Best Practice - use the same exit cap rate as the entry cap as your base case and then analyze the impact that higher or lower cap rates have on your investment return.

I did up a little excel calculator (pictured below) that you can play with to see how different inputs (pink cells) affect the outputs (blue cells).

Small changes can be worth millions. Make sure you understand these levers.

note - for simplicity, assumes all cash purchase, no debt.

1 Quote

“If you’re wearing rose coloured glasses, all the red flags just look like flags”

A Question

What consistently brings you joy?

_____________

If you enjoyed this issue, please forward this email to your friends to subscribe.

Thank you

Eddie Gudewill, CFA

How did you like today's Journal?

Investing Course

If you want to learn everything you need to know to be a great investor, consider my self guided ETF investing course.

Customer review:

"Hey Eddie - your course is precisely what I have been missing and has been so helpful in giving me more confidence to invest myself" - 30 year old MBA student.

What you get

✓ 2 hours video content

✓ Take at your own pace

✓ Training by a real portfolio manager

✓ Excel templates i.e. budget, retirement calculator, rebalancing spreadsheet, and more

✓ Unlimited lifetime access, and all future updates at no cost

✓ 100% money back guarantee. If you don't like it, let me know and I'll give you your money back.

I'm trying to make you a millionaire - not sell you some junk.

You will transform from being unclear and apprehensive, to a capable and confident investor.