Hello everyone!

I have a desire to get more informed about 20th century history and war. Particularly the rise of communism that led to nothing but death and destruction. So I bought this book: The Traitor and The Spy, by Ben Macintyre. Any other recommendations?

If you are enjoying the Journal, please forward to your friends to subscribe.

Personal Finance

The phrase “the gift that keeps on giving” is often heard during the Christmas season - like a fruit tree, an instrument, or a good book that makes the rounds - it stands the test of time and keeps providing benefits.

But there is no better example of a gift that keeps on giving than compound interest.

We’ve discussed this in prior issues (see The Goodwill Investing Journal - Issue #2), but it’s oh so ho ho important that it’s worth revisiting.

So, what is compound interest?

According to Wikipedia: Compound interest is interest accumulated from a principal sum and previously accumulated interest.

In other words, when you make an investment, it earns interest, and that interest earns more interest, and the interest on that interest earns more interest, and on and on.

It’s hard to comprehend these words sometimes, so here’s an example:

$100 invested at 10% becomes $110 → growth of +$10

$110 invested at 10% becomes $121 → growth of +$11

$121 invested at 10% becomes $133 → growth of +$12

$133 invested at 10% becomes $146 → growth of +$13

$146 invested at 10% becomes $161 → growth of +$15

$161 invested at 10% becomes $177 → growth of +$16

$177 invested at 10% becomes $195 → growth of +$18

Look at the growth figures; starts at $10/year, but then it accelerates. In year 7 you make $18/year, a full 80% more than you made in year one. Voila, you’ve doubled your money in 7 years, all due to time and compound interest.

But what does this mean in practice, Eddie?! I only have $10,000 to invest today and I want my portfolio to grow to $1,000,000, but I can’t even imagine getting to $100,000!

Indeed, during the journey from $0 to $1,000,000, the first $100,000 is the hardest.

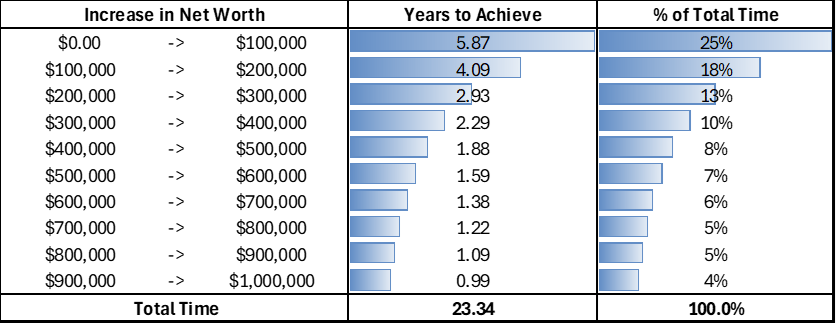

To prove it, please examine this next visual carefully.

Time to $1,000,000 → Investing $10,000/year at 10%

Overall, you can see it takes 23 years to get from $0 to $1,000,000. Not too bad.

The hard part, though, is that the first $100,000 takes 5.8 years, and those years can seem dreadfully slow. So much so that most people in this world throw in the towel and resort to lottery tickets.

But stick it out, because once you get to $100,000, you’re already 25% of the way to $1 milsky.

Each consecutive $100,000 becomes easier and easier, meaning the time it takes to earn gets shorter and shorter.

Your final $100,000 en-route to $1,000,000 only takes one year.

And this doesn’t even factor in your ability to increase contributions along the way as you earn more income throughout your career and spend less than you earn (because you are a lion, not a gazelle).

So worry not, my friends. With time, it gets easier and easier, faster and faster. This is the gift of compound interest. And Santa just left it on your front doorstep.

PS speaking of Christmas, buy the investing course for one of your friends or family members this holiday season. Humbly speaking, I think it qualifies as a gift that keeps on giving.

💝 Newsletter subscribers get 10% off the Simply Investing course with the code: SIMPLYINVEST

🎁 Get $25 when you open a Wealthsimple account. Use my referral code: PRGS3Q

Stock Markets

Perennial “Bear” David Rosenberg has been calling a market bubble for as long as I can remember. He’s the kind of guy that is exceptionally well versed with historical and current economic and stock market information, using various data points to provide a basis for his bearish thinking. It’s hard not to listen to him.

Well, well, well. After two back-to-back +25% years for the S&P500, Mr. perma-bear just wrote a lengthy special to the Globe and Mail describing his “epiphany - and why this bull market may not be as irrational” as he thought.

Excerpt: “It’s high time for me to stop pontificating on all the reasons why the U.S. stock market is crazily overvalued and all the reasons to be bearish based on all the variables I have relied on in the past…This is not about throwing in the towel as much as trying to get a grip on what is going on beyond just calling this a “bubble” every single day…the market clearly continues to anticipate and price in a future boom in productivity that will lead to a secular shift in the trendline for corporate profitability” (full article here).

Simply put, he’s done a complete 180 and accepted the bull market that has completely passed him by (and his investors, too).

I sent the article to one of my uncles and he responded, quite aptly:

“A lot of words to say he doesn't have a clue. Never did. Nor does anyone else. The only fools are the people who listen to these guys thinking that this time it will be different and their predictions will actually be accurate.”

And I couldn’t agree more.

Could the market fall 25% next year? Maybe.

Could the market go up 25% next year? Maybe.

Are we close to a major 1930s depression? Maybe.

Is this the early innings of a secular bull market? Maybe.

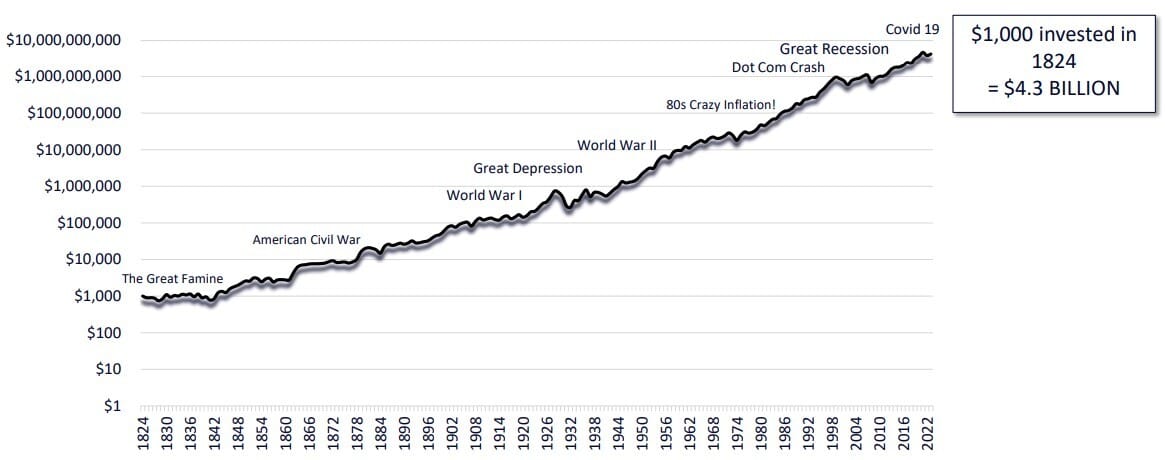

Lesson? Stop listening to the talking heads and their opinions about what you cannot control - that is, central bank interest rates, currency, tariffs, near term predictions, etc, and go back to Section (1) of this Journal.

Focus on what you can control, invest with a long time horizon, be patient and let compound interest do its thing.

And as Buffet likes to say, now is not the time to bet against America.

Value of $1,000 Invested in the US Stock Market since 1824 (log scale)

Real Estate

Someone sends you a real estate investment opportunity. What do you do?

Continue reading below or download the PDF guide so you can save for future use.

Strictly speaking about value-add projects (meaning existing properties with existing income), here’s what I would do:

1. Scan the return figures

Value add returns should be at least 13-15% annualized.

In other words, about 1.75-2.0x your money over 5 years.

Cash flows ideally are 4-5% per year. Sometimes there can be cases whereby the first couple years there are no cash flows, because they are investing capital to improve the income. But after the value-add program, the cash yield should start flowing.

Note, for development deals, the returns should be at least 20-25%+ to compensate for the increased risk.

If they don’t meet those criteria, you should pass.

2. Review the Sponsors

People behind any deal is always the most critical. Who are they? What is their track record?

They should be willing to supply an overview of their historical investment performance.

How much are they investing? If they aren’t in for at least 10% of the equity, you should be wary. Maybe it’s a young entrepreneur that has the requisite skills but no capital, fine. You might be able to negotiate better profit split terms in that case. But if its a team of seasoned executives only putting in a small amount of money relative to their net worth, that’s highly questionable.

3. Check the Entry Cap vs the Exit Cap

Recall, cap rates are valuation parameters, like the Price to Earnings multiple on a stock. I’ve discussed this at length before - see The Goodwill Investing Journal - Issue #42.

Basically, check the Entry Cap and compare that to the Exit / Sale Cap Rate. If the exit cap rate is lower than the entry, ask why? If there is no good explanation, you need to be very skeptical of these sponsors. They are painting a rose coloured picture of the future with the most influential variable that they have little to no control over.

If they defend it by saying, “we are investing capital, improving this building from a C class to an A class”, that is somewhat defendable. But just saying, “we expect cap rates to decline”, is simply unsatisfactory.

4. Review the Opportunity

There should be a 1-page bullet point overview of the opportunity.

Assuming the return projections are satisfactory, this is where the Sponsor will lay out the broad investment thesis. Essentially, why they like it and the overall business plan to unlock those projected returns for investors and over what time period.

Should briefly disclose location, type of asset, summation of the tenancy market, overview of the value add program, what the current rents are at the property vs what market rents are, what the cost to replace the asset if someone were to build a new competing property across the street, etc.

5. Review the Property, Rent Roll, Leasing Fundamentals, Location etc.

Understand the age of the building, what capital expenditure projects have been done thus far to maintain the property, and what future cap ex is required.

Take a look at the tenant roster. Is it a one tenant building? What if that tenant leaves? You’ll have no income overnight. Is it a portfolio of tenants? Does any one tenant have more than 10% or 20% of your revenue exposure? Get comfort here.

Review in detail the leasing fundamentals at the property and for the overall economic area. Is there a lot of new supply coming to the market? If there is, is that outweighed by strengthening demand such that all the supply is being absorbed? Market Vacancy trends are important to review here.

Location analysis and site visits are definitely encouraged and a Sponsor should facilitate this for you if you are considering investing significant dollars.

6. Review the financial projections

This can be cumbersome, but important. You want to review leasing assumptions, tenant by tenant, and get a second opinion on those assumptions if possible.

Stress test the portfolio and cut back your rental rate assumptions and consider whether the deal can still function properly during broad economic pullbacks.

I invested in an Office deal in December 2019 - great timing before WFH completely killed the office sector (ouch) - thankfully, it is a great asset and was purchased at a bargain price at the time and this has enabled the Sponsor to manage cash flow without having to call for more equity.

7. Review the fee structures and promote splits

Typical fee structures

Acquisition fee: 1% to 3% of the acquisition cost.

Asset Management fee: 1-2% of the gross property income

Property Management fee: 3-5% of gross property income

Disposition fee: 1% to 2% of sale price

Preferred return: 6% to 10% return on your equity

Waterfall/promote split: ranges could be from 50%/50% (less favourable to the investor) up to 80%/20% (more favourable).

Finally, you can download the real estate return calculator which I’ve shared many times before to assist.

There’s more and the devil is in the details, but hopefully this is helpful.

End of the day, you want to evaluate three things: People, Property, Deal.

Borrowed that last line from one of my previous employers - let’s see if they read this far today 😊

1 Quote

Everything you can imagine is real

A Question

Imagine your future. What does it look like? What are you doing today that makes that imagination come true?

_____________

If you enjoyed this issue, please forward this email to your friends to subscribe.

Thank you

Eddie Gudewill, CFA

How did you like today's Journal?

Investing Course

If you want to learn everything you need to know to be a great investor, consider my self guided ETF investing course.

Customer review:

"Hey Eddie - your course is precisely what I have been missing and has been so helpful in giving me more confidence to invest myself" - 30 year old MBA student.

What you get

✓ 2 hours video content

✓ Take at your own pace

✓ Training by a real portfolio manager

✓ Excel templates i.e. budget, retirement calculator, rebalancing spreadsheet, and more

✓ Unlimited lifetime access, and all future updates at no cost

✓ 100% money back guarantee. If you don't like it, let me know and I'll give you your money back.

I'm trying to make you a millionaire - not sell you some junk.

You will transform from being unclear and apprehensive, to a capable and confident investor.